Goldman Sachs CEO David Solomon, JPMorgan Chase CEO Jamie Diamon and a host of financial experts warn that the US may slip into a recession in 2023. It’s this “may slip” which creates some market unpredictability and consternation among franchise buyers. Many franchise buyers react to market unpredictability with a “wait-and-see” attitude.

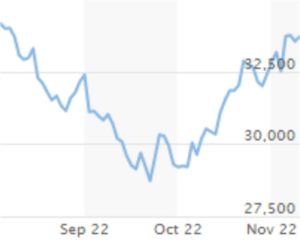

How unpredictable has the market been? Here is a graph of the Dow over the last three months that shows a “V,” pattern, creating more than a 10% dip, and in the last 30 days a 90% recovery.

Market volatility historically is bad for franchising. Predictability is good.

<iframe width=”560″ height=”315″ src=”https://www.youtube.com/embed/3W4Fpa0QLUo” title=”YouTube video player” frameborder=”0″ allow=”accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture” allowfullscreen></iframe>

Recent lead flow and deal flow trends

Keith Gerson from FranConnect recently published an alert which basically reported for most Gerson notes that the typical on their system saw a drop of almost 40% in both lead flow and deal flow when compared to the same time last year.

In his recent Linkedin post, Gerson reported the following:

Q3 2021 Total Leads: 314,430

Q3 2022 Total Leads: 195,213

YOY Change (Q3): -119,217 (-37.92%)

Q3 2021 Closed Deals: 3,265

Q3 2022 Closed Deals: 2,053

YOY Change (Q3): -1,212 (-37.12%)

Other contributing factors

Google reported their total worldwide revenue for Google in Q3 2022 came in at an anemic 2.54 percent year-over-year increase.

What this signals: with Googles ad revenues slowing, franchise opportunity search and display advertising is about to get more expensive.

Since Google has a virtual monopoly on search-engine marketing revenue, expect Google to raise ad prices to drive revenues. Though this may signal a short-term windfall for Google, simply driving up costs without necessarily driving an increase in results or improvements will lead to more dead ends and loss.

Facebook, which used to have strong targeting capabilities, especially with its look-alike lists, hasn’t been able to crack the code since. Already, advertising across industries is proving to be ineffective, sending Facebook stock plunging 70% over the last 12 months. If their stock goes any lower, Mark Zuckerberg may have to buy a franchise.

Now Apple and other platforms are going incognito making it harder to target likely franchise buyers. With deal flow down almost 40% for most brokers, it’s time to accept the conclusion: until the market becomes more predictable, the franchise buyer pie is simply smaller. Here’s why:

Driving Factors of Uncertainty

- High inflation rate. With an historic 8% inflation rate, discretionary income and rates of savings are reduced. Wages struggle to keep pace with inflation, creating less savings.

- High cost of money. SBA loans are now 9.5-10%, from 6% a year ago. This increases risk without increasing rewards.

- Rising labor costs. Unemployment remains under 4%, which is basically a full-employment economy. This is not sustainable. Many companies will be heading to layoffs, which traditionally is good for franchising.

- Transportation costs & inflation. High gas prices are driving higher supplies costs and franchisee COGS. Many franchisees are struggling to pass their increased costs to the consumer in price, as the consumer is also struggling. So many franchisees will predictably earn less, which is bad for validation and franchise sales.

This adds up to more competition for fewer buyers

Basic economic theory shows that when demand goes down, competition increases. Searching under the keyword ‘franchise opportunities,’ SEMRush reports that there were 73 advertisers in October 2022, versus 27 advertisers in March 2022. This signals a 200% increase in advertisers without any noticeable increase in traffic.

Greater competition for the fewer franchises sold is bound to drive the cost of acquiring a new franchise up. Plus, because deal flow is down, many franchisers will likely react by trying to influence brokers with higher commission rates for more sales and leads. Though this may prove a short-term bonus for brokers, with deal flow down, deal flow will predictably be down for many if not most brokers also. Here are the stark numbers.

What can franchisers do?

Franchisers may need to taper expectations or increase their budgets if they want to try to defy gravity. However, here we offer some other excellent ways to steer your brand to safety.

Franchise Performance Group (FPG) works with more than 130 brands over the last 22 years to provide insightful, consultant-driven approaches that help our clients remain in the Entrepreneur 500. As a 37-year franchising veteran, I’ve already recruited franchisees through 4 recessions. Here is what to do:

- Focus on unit-level economics. Ultimately franchisors have to help franchisees make money. That’s priority one.

- Focus on franchisee-franchisor relationships and collaborative solutions. Tough economic times can create an intense operations focus and a foxhole “brother-in-arms” mentality with franchisees and employees of the franchisor. It’s a good time to capitalize on positive relationships and galvanize as a brand.

- De-risk your investment. Incentivize new franchisees to join. In an effort to curry favor with brokers and make up lost revenue, some franchisors raise their franchise fees without increasing the value to the entrepreneur. We recommend the opposite. Take a fresh look at your value proposition as a franchise opportunity and think about how to best add more short term and long term value. FPG client Touching Hearts at Home is a home-care franchisor. They recently went to a fee-simple model, with no marketing or technology royalties. They also make performance guarantees with royalty rebates if sales floors are not hit. This fee simple, shared-risk model is resonating very well with buyers and we are seeing a dramatic lead flow increase.

- Be wise with Google. Google is the largest marketplace for entrepreneurs to find new franchisees. Not brokers. Not portals. It’s Google. This is where almost all buyers go who want what you offer at their point of interest. This is the most cost effective venue to intersect franchise buyers with your value proposition as a franchise.. Advertising life-changing investment opportunities like franchises is very different from trying to sell a brand’s products or services, which is where many franchisors falter. As a result, your in-house marketing department or consumer agency may just not be as effective when trying to advertise a franchise. Consider an agency specializing in franchise lead generation who has a demonstrated track record of success like FPG.***

- Get smart with Facebook. While Facebook look-alike lists still work, they are not working nearly as well as in prior years. That being said, most people who invest in a franchise still use Facebook. Facebook users are a prime franchise-purchasing demographic: (a) among U.S. adults, around 7 in 10 use Facebook and there are 190 million users in the United States alone (b) 75% have an income of more than $75K, (c) 82% are college graduates

- Consistently nurture leads. This might mean something as simple as re-targeted advertising and 1-2 pieces of meaningful lead-nurturing content.

- Tell a compelling brand story. FPG clients all have 15 to 20-page franchise-information eBooks and robust franchise opportunity websites complete with charts, graphs, infographics and a personal story that explains what makes their brand unique. The focus should be on what makes it profitable, valuable and scalable as a franchise opportunity.

- Increase your budget. Resource your development objectives with the proper budget reflective of the competitive times we live in. It takes $10K to $15K in ad spend to recruit a franchisee. It may be higher with more targeted investor groups such as multi-brand, multi-unit restaurant franchisees.

Budgeting Priorities

Here is the FPG playbook by priority and opportunity.

- Get your website right. A good franchise opportunity website converts 2% of its traffic to leads and 1% of the leads make a purchase decision.

- Do the most cost effective deals first: Google, Facebook and (possibly) LinkedIn.

- Pay for play: franchise broker networks

- PR

- Franchise Portals

- Targeted lists, in particular portal opt-in lists

- Events

About Joe Mathews

CEO Franchise Performance Group. FPG’s is a proven full-service outsourced franchisee recruitment solution. Since 2001 FPG has worked with over 120 franchise brands, more than half remain on the Entrepreneur 500 list.

About Franchise Performance Group (FPG)

FPG is a proven full-service outsourced franchisee recruitment solution, including lead generation, franchise opportunity website development, and outsourced franchisee recruitment. Since 2001 FPG has worked with over 130 franchise brands, more than half remaining on the Entrepreneur 500 list.

If you’d like to discuss how best to protect your franchise from down-turning in this market, see what FPG offers.

***Author note. I get it. It’s a shameless plug. You can’t possibly think I am in the business of writing free, albeit still thought-provoking articles!

Image Source: AbsoluteVision