How franchisors can grow by outsourcing recruitment strategy, lead generation and departmental leadership

By Joe Mathews

Founder and CEO, Franchise Performance Group (FPG)

In 2018, franchisors will continue to experience a disruption in their ability to recruit a steady stream of quality franchise candidates and achieve their growth objectives.

This market disruption, caused by multiple factors, creates a supply-side imbalance in the franchisor supply-and-demand equation.

10 Factors that Limit Franchisor Growth

- Oversaturation of franchisors. Research firm FRANdata reports there are about 3,800 franchise brands in the United States. That number is at or near a record high for franchising, largely due to the misperception that franchising is the easiest, cheapest, and fastest way to grow a brand.

- Dwindling pool of new franchisees. FPG and FRANdata estimate that in any given year, only 13,000-20,000 franchise candidates invest in new franchises. A strong economy shrinks rather than increases the pool of available candidates because of a secure job market.

- Hundreds of new franchisors emerge each year. In any given year, 250 to 350 new concepts choose to franchise, adding more noise to a crowded marketplace. Most new concepts do not add new buyers; instead, they dilute the available market and disrupt the demand/supply curve.

- Decrease in new business starts. The U.S. Census Bureau reported 414,000 new business starts in 2015 — the lowest total recorded in over 40 years — which is off the normal pace of 500,000-550,000 starts. Since then, the Bureau of Labor Statistics reported the unemployment rate has declined another 20%-25%. Based on our experience with past economic recoveries, FPG believes new business starts will continue to decline.

- Lower investor risk tolerance. The Bureau of Labor Statistics reported that December 2017 unemployment was at 4.1%, the lowest in almost 10 years. When unemployment is high, starting a business looks more secure than the job market, but when it’s low, the job market looks more secure than starting a business. In a full employment economy, employees become scarce, wages go up, and the job market becomes more attractive than in a stagnant economy with 6%-9% unemployment as in the recent past.

- The surging stock market outperforms the financial returns of most franchise opportunities. When the stock market surges, franchise candidates experience excellent returns with lower perceived risk than a franchise opportunity. Many resist pulling out funds to start a business because of the high perceived opportunity cost of money due to perceived lost opportunity. Many potential franchise investors sit on the sidelines until the market cools.

- Disruption in the franchise broker community. Many hundreds (if not thousands) of poorly trained people are taking advantage of the low barriers to becoming a “franchise consultant,” confusing and deterring potential buyers and disrupting franchisors who have become reliant on broker deals to hit their growth objectives.

- Spiking real estate costs. Brick-and-mortar location sales have not kept up with rising real estate costs. In today’s competitive retail and foodservice environment, these costs cannot be pushed to customer without the risk of losing customer traffic.

- Rising labor costs and projected $15 minimum wage. Many franchisors have not responded to rising labor costs, which eat into franchisees’ margins but do not impact the franchisor’s royalty streams. Many restaurant and retail concepts cannot absorb these costs and pass them off to the customer without decreasing customer traffic and hurting revenues. The diminished returns are often not worth the financial risk to their target franchise candidate, which inevitably will grind new openings to a halt.

- Weak franchisee recruitment. Over the years, career franchise sales professionals have not kept up with changing franchise buyer behavior and now operate behind the curve. Many haven’t sharpened their skills or altered their tactics to be consistent with how franchise buyers buy.

The Evolution of Franchise Buying

Here is how FPG sees the franchising buying process evolving and how franchisors need to respond to stay ahead of their competition and current with the marketplace.

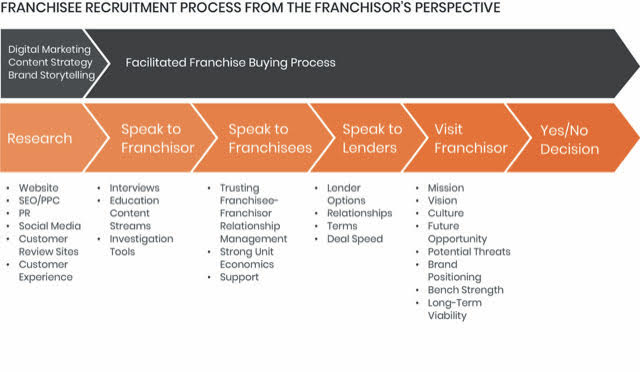

From the candidate’s perspective, their investigation process looks linear. They think, “First, I will check out the franchise online. Then I will talk to someone at the franchisor’s office. Then I want to talk to some franchisees and get a feel for the numbers. Then I will explore my financing options. If the financials make sense, then I will sit down and meet with the franchisor. If that goes well, I will invest.”

They don’t realize that the franchise buying process is highly complex and has multiple layers.

Franchisee recruiters should know this, but too many recruiters try to force, influence, or manipulate franchise candidates down a different path they call “the franchise sales process.” Because candidates know they are being sold rather than being assisted, they often put up walls, create resistance, and eye the recruiter with caution. These franchise sales people simply have not kept up with changing buying behaviors and haven’t made the tactical shifts required to stay current. Many don’t know how to guide a candidate down a facilitated, candidate-centric investigation process. They only know how to run a franchisor-centric sales process — the exact opposite of what the candidate wants — creating credibility issues and diminished results.

The old paradigm recruiter clings to the idea, “Just get me a qualified lead and I can close them,” seemingly oblivious to the fact that how they approach their recruitment funnel is the same reason they don’t have qualified candidates to “close.” Many simply haven’t honed their skills produce great results in a buyer-driven, information-rich, highly complex decision-making process.

For those who understand the buyer’s decision-making process, keep current with changing buying behaviors and take advantage of updated tools and tactics, the process looks something like this:

If your process is largely still PowerPoint decks and conversation, you are operating from the old “franchise sales” paradigm that doesn’t fit the new facilitated, franchise candidate-centric investigation process buyers are expecting.

To plot out this kind of new paradigm, self-directed lead generation and lead-nurturing content strategy, franchisors need to harness the talents of web developers, business writers, programmers, social media experts, PPC and SEO optimizers, videographers, and a PR firm. Stop and think about this. That’s one brand value proposition spread out over as many as eight different employees or vendors, each with its own take on the brand and wanting creative control over their area of expertise. That’s many moving parts, leading to multiple potential breakdowns if the franchisor fails to fully integrate all of this domain-area expertise into one fluid franchise investigation and buying process.

If this sounds like a daunting task, that’s because it is. The same self-directed investigative buyer behavior that now drives an estimated first 70% of the auto-buying and home buying decision-making process is creeping into the franchise buying process. Many franchisors have been slow to adopt and respond.

Is This the Future of Franchisee Recruitment?

The franchisee recruitment department of the future is going to have part-time content writers, web designers, digital marketing specialists dedicated to franchising, and shared videography and PR services. Because candidates demand more information to help them determine fit before they engage the franchisor in conversation, the franchisee recruitment process will shorten as candidates opt-in later in the process. This assumes franchisors do a satisfactory job of offering them more credible and trustworthy investigative content.

Because franchisee recruiters will engage candidates later in the process, they will work fewer leads but end up with more franchisees, making the process far more efficient than the historial 1% lead-to-close ratio.

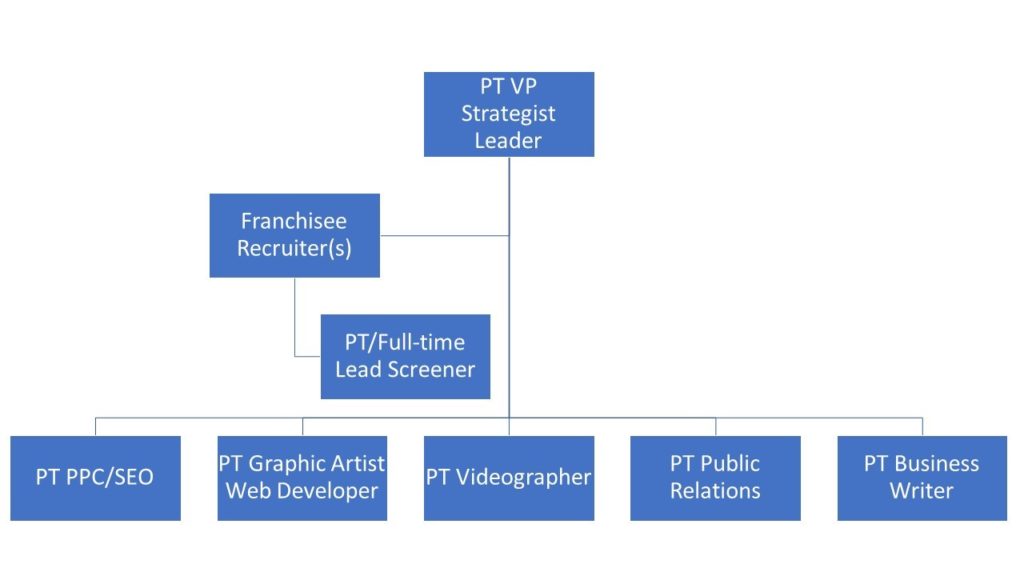

To stay current, the franchise recruitment payroll roster and fixed overhead will significantly increase, and the organization will look something like this:

Since many of these roles require part-time effort, the franchisor will be managing more employees working fewer hours.

Your 1st Inclination is Most Likely a Bad Idea

The franchisor’s first attempt to stay current and employ fractional labor will be to have their existing marketing department or consumer marketing vendors pull double-duty.

That instinct stems from the faulty premise that “marketing is marketing,” meaning that success in consumer marketing translates into success in marketing high-ticket investment opportunities such as franchises.

This is a false assumption. Consumer-facing marketing departments and vendors have created such priceless jewels as:

- “Own a T shirt franchise that fits you like a T”

- “Reel in Customers with Real Seafood”

- (Multiple pizza franchises have tried this one on) “Own your Slice of the $40 billion dollar pie” or its evil twin, “Make some real dough in the pizza business.”

If you aren’t reading this and saying, “UGHHHH!,” then you aren’t a franchise development career professional.

Aside from not having relevant backgrounds in marketing highly complex investment vehicles, they also make marketing decisions from what impacts the top of the funnel rather than what impacts the bottom.

Simply put, you don’t need more leads to close more deals. Driving leads is mindless and easy. It also doesn’t make a difference.

The marketing challenge is to intersect active target investors at their point of interest in information-gathering with the brand story.

It’s not a numbers game anymore. It’s a game of skill.

For instance, FPG published an article about Wild Birds Unlimited where leads were down 16% and deals up almost 50%. In 2016, FPG increased College Hunks’ deal flow by 50% while lead flow decreased lead flow by 8%. For one national home healthcare provider, lead flow went down 50% while FPG increased qualified applicants by 40%. Lead generation is easy. Franchise buyer generation takes knowledge and skill.

The typical consumer-facing marketing team will seek to drive lead count, assuming more leads means more deals. They’re blind to the organizational costs, the distraction and the disruption that high-volume, low-quality lead flow causes within the franchise development department. One franchisor figured they spent $80,000 per year in labor costs to follow up on portal and social media leads with no payout.

The Case for Outsourcing

“New paradigm” recruiters who understand the challenge of recruiting new franchisees in the digital age are in short supply and high demand. This drives up their value, and they become expensive. But franchisors need what they possess because the experience level and capabilities “old paradigm” franchisee recruiters are becoming less relevant in the new self-directed franchise candidate investigation process. This means it’s not the time for franchisors to go cheap.

While few career franchisee recruitment professionals demonstrate the capability to achieve a breakthrough, many more professionals are capable of following processes these thought leaders create. So, hypothetically, companies may only need to turn over the reins for a couple of years to create momentum for a paradigm shift.

Companies like FPG offer clients fractional leadership and advisory services to cost-effectively create a breakthrough. FPG executives have the capacity to assume strategic leadership roles for multiple brands. This allows franchisors to benefit from best-in-class strategy and execution without having to pay the $250,000+ demanded by a best-in-class Chief Development Officer.

It’s in the best interest of both the highly experienced, talented thought leaders and franchisors that they come together on a fractional or short-term basis. An emerging growth franchisor may not need their full-time efforts. The thought leader may want to diversify their income and risk over a few emerging growth or resurging brands.

That potentially solves the franchisor’s departmental leadership conundrum, but what about the hiring, management, and integration of the domain-area experts required to create a breakthrough in the complex and multifaceted “new paradigm” franchisee recruitment department?

To hire the necessary digital and content team on a part-time basis will cost the organization well into the $150,000-$250,000 range annually, with no guarantee of a return.

In addition, many of the key digital and content creation players will have never marketed for franchisees. Franchisors can expect a 2- to 3-year learning curve as the team learns, through trial and error, the most effective tactics for marketing high-ticket, high-involvement, and high-risk investment opportunities. This means burned advertising dollars on top of an inefficient labor cost model.

FPG solves this problem for franchisors because we already have a fully integrated franchise development, outsourced sales and marketing solution specializing in franchisee recruitment. We give franchisors the freedom to manage one vendor rather than having to hire, integrate, and manage 7 to 8 employees or vendors and hope they can work together to create a breakthrough. FPG has already taken the risk to hire, train, and develop a team that has already honed their skills over the years with multiple brands and investment levels. Because we can spread the expense of high capacity players over multiple brands, many franchisors find our solutions very cost effective. Because we practice our craft with franchisors of multiple investment levels, industries, and target buyer profiles, and don’t dilute our talents with customer-facing marketing, we stay sharp and current.

Such a team is expensive and time-consuming to create and complex to manage. In addition, a large and diverse franchise development team is often hamstrung by its weakest or most disruptive player. Lastly, franchisors inadvertently run the risk of mixing “new paradigm” thinkers with the old, creating warring fractions and diminishing effectiveness and results.

Regardless, franchisors who wish to stay ahead of the competition by anticipating the desires of today’s self-directed franchise buyer need to take action or risk becoming irrelevant. Smart franchisors design their departments based on where the market is heading rather than where it has already been.

Common Outsourcing Mistakes

Assuming a brand’s franchisee validation is strong and unit-level economics are solid, the franchisor is primed to grow. A skilled franchise recruiter often doubles or triples the productivity of marginal and average recruiters. Rather than doubling the ad spend to get the same or weaker results, franchisors would be wise to invest a premium in a highly skilled, next-generation franchisee recruiter. The “I need more and better leads” mentality of marginally skilled recruiters just doesn’t cut it in this hyper-competitive franchisor environment. Skilled recruiters simply recruit more franchisees with fewer leads.

Outsourced franchise sales specialty organizations are springing up quickly. Franchisors think, “If I focus on unit-level economics and franchisee performance and satisfaction and I no longer have to worry about franchise sales, we can achieve greater operational excellence and higher profitability.” That is a sound strategy for long-term sustainability and profitable growth.

Many franchisors see their intentions thwarted because too many outsourced franchise sales companies either aren’t producing the excellent results they promised or they are extracting far more value than they create. Franchisors could sidestep these disasters if they knew what to avoid, what questions to ask, and when to walk away from the negotiating table.

Here is a list of 6 common mistakes Franchise Performance Group finds franchisors consistently make when hiring outsourced franchise sales companies to represent their brands. Please don’t do this.

- Confusing “years of experience” with competency and results. Many outsourced franchise sales firms burn through clients looking for the one concept that might take off. Demand their complete client list, not just a list of their few victories—even a blind squirrel will find an acorn from time to time. You would be shocked to learn how many outsourced franchise sales firms fail their clients on a regular basis and then move on to the next concept, leaving dead bodies and wasted budgets in their wake.A strong outsourced franchise sales team can help your brand succeed. A weak team just rides the brand’s coattails looking for a few easy deals to pick off and then moves on or gets fired.

- Hiring outsourced franchise recruiters without meeting them first. As far as the franchise candidate is concerned, the outsourced franchisee recruiter is an extension of the brand. The brand owns everything they say and do. With each conversation, these recruiters are adding value or tarnishing your brand. Meet them in person. Most importantly, make sure they are a culture fit and share your brand values.You are hiring both the recruiter and the firm they work for. Have the recruiter role-play and interview you for a franchise. If you were a lead, would you request to take the next step in the process or opt out?Ask yourself, “Are they instantly credible?” “Did I trust the feedback or was I being ‘sleazed’ and manipulated?” “Is this how I want my brand represented?” and most importantly, “If given the opportunity, would I hire this person?”

- Being assigned a franchisee recruiter you would never hire as an employee.

If their style, work ethic, communication style, values, or skill level isn’t up to your internal standards, then don’t go forward. If you don’t think they will connect to your target franchise candidate, take a pass. - Paying commission only. Franchisors think commission-only relationships save money and mitigate risk. In reality, they dramatically increase risk and run the highest risk for tarnishing the brand.Professional franchise recruiters earn their value two ways: First, by recruiting high quality franchise candidates. Secondly, by screening out mediocre or weak candidates, thus eliminating downstream operational problems or potential failures. When franchisors pay commission-only, they are putting the franchise salespeople in a position to recruit questionable candidates they would normally take a pass on.Typically, it takes about 120 days for a new franchise salesperson to recruit their first franchisee. This means they are working at least four months for free and burning through their savings in the meantime. Just like everyone else, they need income. Sometimes this means turning a blind eye to marginal candidates and pushing them through the process, creating long-term operational problems for short-term money.In a similar way, commision-only salespeople focus on closing deals when the pipeline gets fuller and won’t give time or attention to new leads coming in. They might have a great month then not close anything for several more months because they let too many leads fall through the cracks.If you are paying a retainer, you will get a more skilled recruiter and results that are more consistent with the long-term objectives of the company. The retainer should equal the salary that the market pays a full-time equivalent franchise salesperson for that same role.

- Being one of too many. Many outsourced franchise salespeople and firms work multiple accounts, hoping one brand clicks and takes off. Unskilled recruiters will often ignore the franchise that is harder to sell in favor of the “short putt” concepts. A best-in-class recruiter can represent more than one brand effectively. A marginal recruiter cannot, and the brand that’s harder to market will suffer.

- Paying a premium for franchise broker contacts. There is a cottage industry of outsourced franchise development, where companies are relying on franchise broker leads to bring candidates to the table. Given the hundreds if not thousands of new brokers entering the market because of its low barriers and high commissions, brokers, like franchisors, are also facing major disruption. Outsourced recruiters need to bring lead generation to the table also, or they are operating from an old paradigm, rapidly diminishing in returns. The days when an emerging chain could build a national brand off the lead generation strategies of the franchise broker community, with the possible exception of a few brands per year, are over.

Build Your Recruitment Team to Build Equity

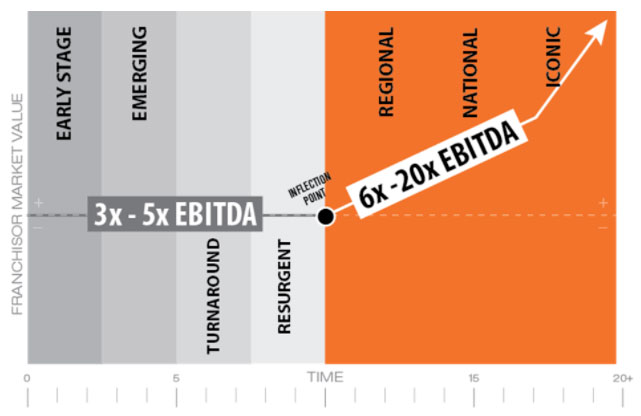

Private equity firms value franchisors based on the long-term predictability of the recurring revenue streams. The more predictable the streams, the more likely the equity firm will attach a premium to the brand’s valuation.

Private equity firms also attach a premium or subtract value based on the leadership team and key vendor relationships. Certain strategic partners with stellar reputations within the franchisor community add equity value to the franchisor’s business by mitigating the perceived risk of the equity firm acquiring the brand. They know if certain firms touch a brand, the foundation is strong. They also know if other firms touch the brand, there are skeletons in the closet and baked-in added risk. They discount the value of the company as an insurance policy should one of more of the skeletons come out and create chaos.

Some of the high-value outsourced firms may forego premiums for the opportunity to share in long-term value add of the brand you build together. These firms don’t act as vendors, they become key strategic partners.

One way these firms seek compensation is through a royalty share for a period of time. This can work if the franchisor has a buy-back provision in the agreement as not to diminish the equity value of the company. The franchisor may lose short-term cash flow, but with a buy-back provision they protect 100% of the equity. At resale, the franchisor can recast earnings based on the buy-back provision and receive full equity valuation as if they realized the full royalty revenue and what would have flowed to the bottom line.

The Impact of Private Equity on Recruitment

Private equity has stormed into franchising, searching for growth opportunities. Based on our experience, the premium valuation inflection point franchisors need to bust through to extract a premium is $2 million in EBITDA, and 100 franchisees or territories.

FRANdata research shows about 18% of the current crop of franchisors successfully navigate past 100 territories, units, or franchisees and position themselves for a premium valuation.

For more information on what happens to the 82%, click here to read my articles titled Where Most Franchisors Break and Is the Franchising Bubble Ready to Burst?

Private equity will create models and methods to distinguish “quality growth” from “pumping numbers” and add a premium, discount, or run away from the deal accordingly.

Bringing that back into outsourced franchise development, the right partner will fill the funnel with quality candidates and bring a disproportionate share of quality growth into the brand. They will also have the skills and experience to assess candidates and distinguish those who possess the highest probability for success and those who most likely will create tomorrow’s operational nightmares and disruptions for the brand.

Franchisors uniformly state they burn 80% of their time and energy, as well as a disproportionate share of their financial resources, trying to prop up underperforming franchisees. Bad recruiting topples emerging growth franchisors and kills forward momentum faster than most any other external market or competitive threats.

With every franchise awarded, a franchisor sows seeds of success and destruction. The next generation recruiting firm will have skills, systems, and processes to distinguish which is which. In addition, they will have the digital marketing resources and know how to cut through the noisy marketplace and intersect the franchise buyer with the brand story while they are conducting their online research.

About FPG

FPG is a thought-leading specialty consulting firm helping franchisors achieve breakthroughs in franchisee recruitment results. We collectively have almost 100 years of franchising experience as executives, multi-unit franchisees, and suppliers to franchisors. Since our inception, we’ve worked with 110 emerging growth, regional, national, and resurgent brands including Arby’s, A&W, BrightStar Care, College Hunks Hauling Junk and Moving, Huddle House, Chem-Dry, Taco John’s, Great Clips, Molly Maids, Fantastic Sams, BP and Subway.

About Joe Mathews

Joe Mathews, founder of Franchise Performance Group, has more than 30 years of experience with such national chains as Subway, Blimpie, MotoPhoto and Entrepreneur’s Source. He is a regular presenter at IFA conferences, and has served as an instructor with the ICFE (Institute of Certified Franchise Executives). Joe specializes in franchisee recruitment, franchise sales and franchisee performance. He is author/co-author of four books: Street Smart Franchising, Franchise Sales Tipping Point, Developing Peak Performing Franchisees and How to Create a Franchise Sales Breakthrough. Guaranteed.