Cartoon character Homer Simpson was driving down the street when his engine light suddenly went on. Homer pulled over, broke off a piece of black electrical tape and placed it over the engine light while proudly proclaiming, “Problem solved.” In my experience, many franchisor leaders also fail to distinguish between the engine light and the real problem. Here’s how they can actually solve their problems and drive their brand to greater success.

4 Brand Drivers

Ultimately the franchisor model has four key factors which drive the total health of their system:

- Franchisor capitalization

- Business model unit-level economics

- Franchisee talent pool

- The quality of the franchisee-franchisor relationships

For instance, FPG gets many calls about assisting franchisors in a turnaround situation. They look at metrics such as “lead-to-close ratios,” “Cost-per-deal,” “Speed-to-lead,” and other sales KPIs, reducing problems down to oversimplified franchisee recruitment metrics.

When we peel back the layers and look at the core business, we find things like this: the model doesn’t work in higher occupancy or labor cost geographies; the franchisee-franchisor relationship is strained; their management team is weak; strategy is out the window and the leadership team is engaged in daily firefighting; the competitive set has changed, which in turn hurts profitability of some franchisees; and start-up costs are rising, lengthening break-even and creating systemic undercapitalization of franchisees.

When we point these issues out to leadership, they often myopically say, “We had no problem selling it last year. We just need more qualified leads.”

Given the oversupply of franchisors, how many franchise candidates would knowingly invest in a franchise with the following characteristics?

- Weak and myopic leadership team

- A business model which doesn’t fare well against competitors

- Start-up and operating costs are increasing, and margins are getting squeezed

- Increased competition is cutting into revenues and profitability

- No turnaround strategy

Of course franchisee recruitment results will decrease as a direct byproduct of these larger system breakdowns. In turnaround situations, franchisee recruitment results slowly come back only after the brand has successfully executed a turnaround. Recruitment results are generally the first to go and the last to come back.

Confusing lag indicators with lead indicators

A lag indicator is a key metric that tells you what occurred. As stock brokers are prone to say, “Past performance is no guarantee of future results.” A franchisor that primarily bases strategic decisions on lag indicators is driving a car forward by looking in the rear-view mirror.

Lead indicators best represent the brand’s windshield and tell you where the chain is predictably going. FPG lists what we believe to be the most accurate franchisor lead indicators below. This broad outline is designed to stimulate thinking and in no way represents the final word on franchise brand lead indicators. In addition to these, each brand may have its own set of indicators unique to its situation.

Lead indicators include:

- The franchisees’ most current results, such as:

- Unit-level economics

- Customer traffic

- Average ticket

- Net promoter scores

- The franchisor leadership’s ability to correctly identify opportunity and set workable strategies to capture a disproportionate share of the available market.

- Capacity and skills of the leadership team. Do they have what it takes to capture new opportunity that exists? Is the brand unique to the marketplace, profitable, valuable to the customer, and defensible against competition?

- Do franchisees have the skills and resources to capture opportunity and stake a defensible position in their local market?

- Do franchisees believe capturing new opportunity is a worthwhile pursuit and are willing to invest the time, money, and energy it takes to capture this opportunity?

- What is the franchisor’s ability and capacity to act as an internal consultant, identifying and capturing opportunity?

- The franchisor leadership’s ability to correctly identify potential competitive or disruptive threats and create strategy to defend against it.

- Capacity and skills of the leadership team.

- Have they created a unique model that is difficult to copy? Can customers distinguish the brand’s unique value compared to competition? Has the franchisor’s leadership team crafted a model with high barriers to competition?

- Do the products, services, brand, delivery methods, and value proposition appear relevant and valuable into the foreseeable future?

- Do franchisees have the skills and resources it takes to stave off competitive threats?

- Are franchisees willing to invest the time, money, and energy it takes to defend against threats?

- Capacity and skills of the leadership team.

- The quality, stability, and workability of the franchisee-franchisor relationship. Right this second, are franchisees willing to be led by the franchisor? Do franchisees trust in leadership and buy into the leader’s vision and stated direction?

- Scalability of the leadership team. Right now, does the executive and leadership team have the organizational skills, vision, and capacity to successfully navigate the next inflection point in the franchisor’s life cycle?

Keep in mind that what gets the franchisor through the last inflection point becomes a barrier to getting through the next. Each inflection point requires greater executive skills and an organizational need to reinvent.

The 2-Year Decision-to-Brand-Impact Lag Time

Since franchisors cannot often experience or measure the impact of their decisions for up to two years, most franchisors are not fully aware that the impacts of these decisions are accruing. Over time, poor decisions made by emphasizing data from lag indicators and ignoring lead indicators will surface as a series of significant breakdowns, ultimately leading to a turnaround situation. Unfortunately, many times the appropriate fixes exist outside the organization’s skills, capacity, and resources.

For example, high-flying Emerging Stage franchisors often double or triple their recruiting results from the Early Stage, outstripping the organization’s capacity to provide the same level of training, care, and support previous franchisees counted on. The organization may falsely believe training 25 new franchisees just requires a bigger classroom, instead of an entirely revised and expanded training department. Perhaps franchisees’ real learning came from the franchisor’s field consultants, who provided a high level of one-on-one support to compensate for insufficient classroom instruction and opening support. Now the field consultants don’t have the bandwidth to provide the one-on-one attention, to the financial detriment of the newest franchisees.

Until these franchisees have been open more than a year and a training problem leading to a franchisee revenue ramp-up problem is identified, the chain continues to aggressively recruit franchisees, ensuring even greater organizational strain and weaker-than-anticipated franchisee results.

During that 2-year period of rapid franchise sales growth, the franchisor falsely assumes they are winning but has been planting seeds of destruction with each successive franchise agreement. Too often, franchisors expand more quickly than the organization’s capacity to diagnose and fix the problems. That creates a community of highly dissatisfied and struggling franchisees.

3-Year Planning Horizons

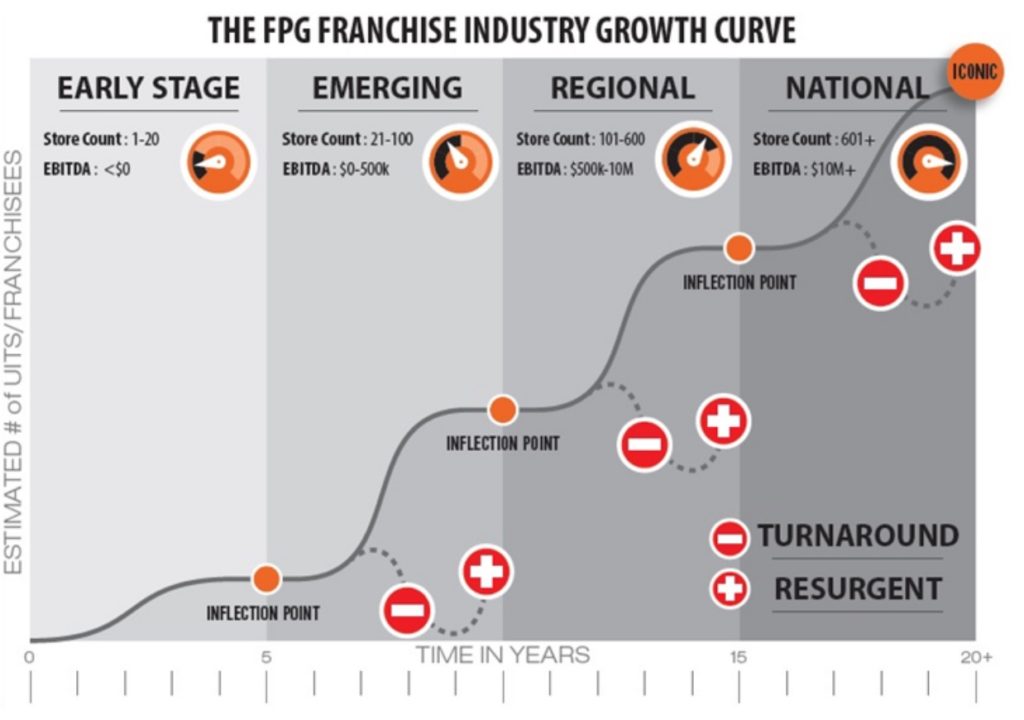

Because each stage in the FPG Franchise Growth Curve is identifiable and predictable, and each stage requires its own success strategy, franchisors should always be planning for the next stage while implementing the appropriate tactics for the existing stage.

Franchisors who are not currently working from a 3-year planning horizon will often pivot too late. At the bare minimum, that means missing growth opportunities and slowing momentum, but it often also sends the chain into decline and Turnaround status.

For example, in Emerging Growth franchisors, leadership wears many hats. As the chain experiences exponential growth and moves towards the Regional stage, it will be time for the franchisor to beef up its organization. If the C-suite wasn’t interviewing the best hires already, they will soon be stretched thin and respond by promoting employees who are not a fit or adequately trained for the advanced position, or they will make rapid needs-based hires in hopes of being able to build the plane as they fly it. The elevated employee may fail, then quit or be fired, losing valuable brand experience and expertise. Or they may achieve minimally acceptable performance, producing just enough not to get fired, but not enough to move the chain to the next level. New leadership hires may bring in processes or business philosophies that are not a fit for the brand, such as bringing a “command and control” ideology into a system with a more informal franchisee-franchisor relationship. This disconnect, if allowed to continue, will predictably breed franchisee dissatisfaction and poor validation. Since the chain is moving fast and too busy to police culture, dissatisfaction will predictably fester and grow within the franchisee ranks and only be diagnosed after a massive breakdown occurs.

Educated franchisors act differently. They assume what worked yesterday will be a barrier to entry into the next growth stage. They don’t wait for system failures and they accurately anticipate the organizational barriers. Then they plan accordingly.

For instance, the chain may have proven it can successfully onboard 12 franchisees per year. While the chain is perfecting it’s “onboarding 12” model, the leadership steering committee is envisioning and creating resources for a chain that successfully onboards 40 new franchisees per year. Then they go build it ahead of the growth.

Why is Franchising Complex and Difficult?

Any career franchising professional already knows franchising is a business unto itself. However, franchising has never done for franchisors what successful franchisors do for franchisees, namely codify the business model.

“The franchisor step-by-step business format model” doesn’t exist in a written playbook anywhere. There is no “Franchising Ph.D. program” and it isn’t studied in-depth on the university level. There are no franchising business analysts. Franchising exists as PowerPoints at the IFA Convention, Wednesday webinars, coffee shop conversations at various conferences, articles on LinkedIn, and a host of other places. Franchisors then stitch together what they hear and believe are best practices and then make up the rest. What other nearly trillion-dollar industry has as little market intelligence and codification as the franchisor business model?

There is no proven franchisor business model for franchisors to follow that maps out what Early Stage, Emerging Growth, Regional, and Turnaround Stage franchisors need to be working on every day over the next 5-10 years to grow an iconic national brand. There is no business plan for what their total cost structure will be, where cash is allocated, when they will achieve royalty self-sufficiency, where re-investments need to be made in infrastructure, who they need to hire and when, what strategic banking and vendor relationships they need and when, and what internal and external threats occur and at what stages.

That’s why out of the roughly 3,800 brands in franchising, 82% aren’t yet past the 100 unit or operating territory mark. FPG models show that royalty self-sufficiency generally occurs between 50-100 operating units or territories, meaning most of these franchisors aren’t yet viable. Franchisors don’t know what to do and operate through a series of best guesses based on what worked in the past, with no real understanding if what worked in the past is the right strategy for what needs to happen in the future. But this will change.

The Bottom Line

Within the franchising community, everything a franchisor needs to succeed is already here. It simply hasn’t been pulled together into one cohesive and workable plan, which can take any valuable franchisor from Early Stage to Iconic National Brand with over 700 units or territories within a 10-year time period… but at FPG, we’re inventing it as fast as we can. There is too much money at risk, and money to be made, for franchising to continue operating like the Wild West.

Join the New Franchising Thought Leaders LinkedIn Group

Join FPG’s moderated LinkedIn Group dedicated to forward-thinking franchisor professionals, franchisees, suppliers, private equity, lenders, and all students of the franchising industry.

Franchising Thought Leaders. No advertising. No personal agendas. Just “must-read” content, thoughtful discussion, case studies, and debate about franchising best practices and the future of franchising.

About FPG

FPG is a thought-leading management consulting firm specializing in franchising. We collectively have almost 100 years of experience working all aspects of the franchising ecosystem, such as franchisor executives, multi-unit franchisees, and suppliers to franchisors. FPG offers franchisors a proven business format and platform to successfully propel the brand from the Emerging Growth stage to Regional, National, and Iconic brand status. We also help turnaround brands resurge. FPG operates much like a franchisor, but without a specific brand.

www.FranchisePerformanceGroup.com

About Joe Mathews

Joe Mathews is founder of Franchise Performance Group and a student of national brand building that leverages franchising. Mathews has more than 30 years of franchise management and leadership experience with such national chains as Subway. He is a regular presenter at IFA conferences, and has served as an instructor with the ICFE (Institute of Certified Franchise Executives). He specializes in franchisee recruitment, franchise sales and franchisee performance. He is author/co-author of four books: Street Smart Franchising, Franchise Sales Tipping Point, Developing Peak Performing Franchisees, and How to Create a Franchise Sales Breakthrough. Guaranteed.

Joe Mathews is founder of Franchise Performance Group and a student of national brand building that leverages franchising. Mathews has more than 30 years of franchise management and leadership experience with such national chains as Subway. He is a regular presenter at IFA conferences, and has served as an instructor with the ICFE (Institute of Certified Franchise Executives). He specializes in franchisee recruitment, franchise sales and franchisee performance. He is author/co-author of four books: Street Smart Franchising, Franchise Sales Tipping Point, Developing Peak Performing Franchisees, and How to Create a Franchise Sales Breakthrough. Guaranteed.