Capitalize on the Current Market Disruption

It was September 29, 2008. I was sitting in the second row at the Franchising Update Conference opening session, right behind keynote speaker, stock market analyst, economist, and Fox Business Network Host Stuart Varney. I watched him fidget and look at his notes as he was being introduced. There was an agitated buzz in the room. Rumors were swirling about the stock market taking a hit. It turned out to be the single largest point drop in history.

Varney walked up to the podium and told the crowd his prepared speech was irrelevant. We were entering a recession. He delivered the greatest “on-the-fly” analysis and survival tactics I have ever heard.

Within 18 months, the stock market was down 50%. Banks stopped lending. Franchising was disrupted. Franchise candidates stopped investing at historic levels. Units closed.

For the next several years, the primary franchisor concerns shifted from “How do I close more deals?” to “How do I stop franchisees from closing?”

I watched a panel of CEOs discuss their vision and strategies for keeping their brands afloat during these highly turbulent times. They discussed things like, “Treat vendors like strategic partners,” “Build lending relationships,” “Raise the skills and competency level of franchisees,” “Run lean,” “Cut the fat but protect your skilled leaders at all costs,” “Drive revenue,” “Protect key customer relationships,” and “Stay in communication with your franchisees. Be transparent. Treat them as partners.”

One particular CEO summarized it best. As he heard the CEOs on his panel, Steve Greenbaum, co-founder and then-CEO of PostNet chuckled a bit and then asked the panel, “Is there anything you are doing that you shouldn’t have always been doing anyway? Isn’t this just executing the basics?”

And he was right. Regardless of the external circumstances, the franchisor success formula seems to be simple, elegant, and highly predictable. But the franchisor model isn’t packaged as such. Having spent over 30 years in franchising, I believe franchising has not perfected the “business of franchising” to the same degree that successful franchisors have perfected their consumer-facing models.

The Risk of Conventional Franchising

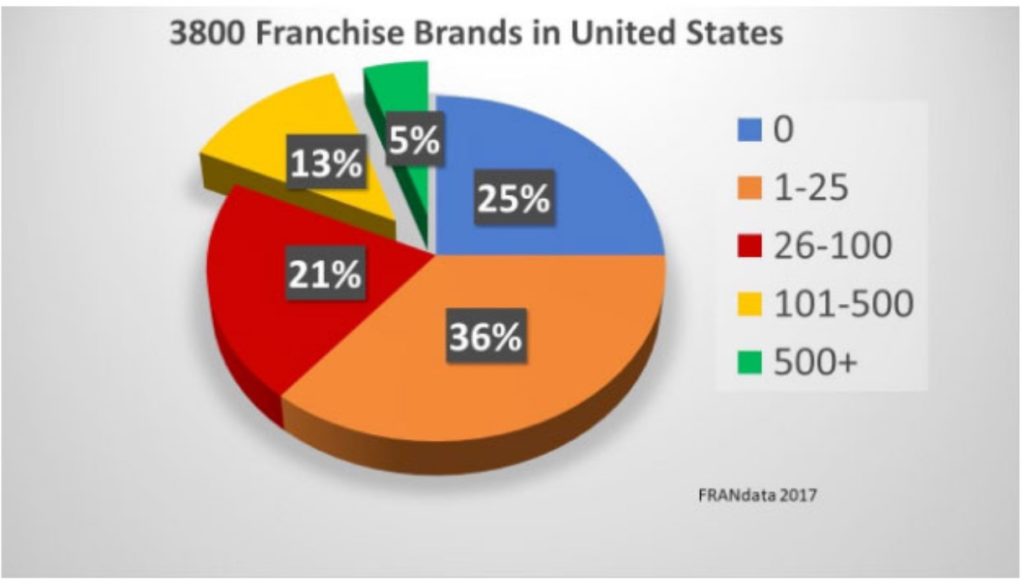

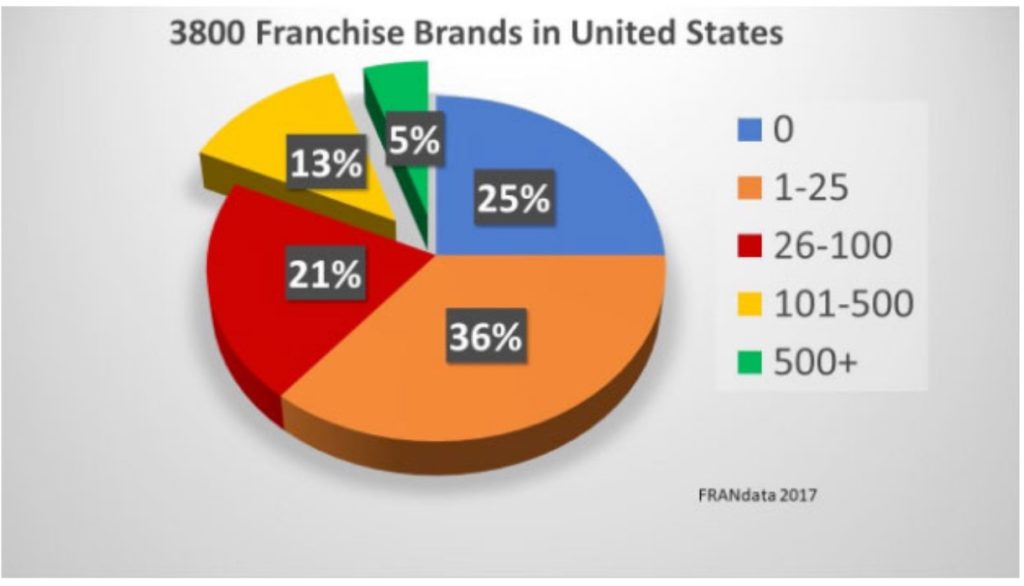

In 2017, FRANData reported 82% of franchisors had fewer than 100 operating territories or units. FPG financial models show many franchisors don’t achieve royalty self-sufficiency, our best measure for franchisor sustainability, until they cross the 50 to 100 operating unit or territory mark.

What this really means…

Even if the average franchisor attends all the franchising conferences and events, networks with others, attains their CFE designation, executes expert advice, and implements best practices, the clear majority of these franchisors and their franchisees will still struggle to remain viable. According to FPG franchisor modeling, until franchisors crack the 50-100 operating territory or unit market, many of them are not financially viable for the long haul.

The Current Market Disruption

Franchising is currently suffering from a double hit and won’t see relief soon. The first issue we just discussed. Franchising has never done for the franchisor what franchisors regularly do for franchisees: codify, train, and support them on a proven and successful business format. The franchisor business model has never been defined, codified, and systematized. This article will address this on a strategic level later.

The second set of issues are external limiting factors. Like 2008, the franchisee recruitment market is tightening. Some of the limiting factors include:

Oversaturation of franchisors. Research firm FRANdata reports there are about 3,800 franchise brands in the United States, at or near a record high. On top of that, in any given year 250 to 350 new brands throw their hat into the ring without significantly increasing the available market. FPG and FRANdata estimate that in any given year, only 13,000-20,000 franchise candidates invest in new franchises. That’s roughly 4 to 5 new franchisees for each franchisor. If the average franchisor needs 50 to 100 operating units and territories to sustain operations, the typical franchisor ramp-up is currently 10 to 20 years.

Franchising has been operating as if it is an “All You Can Eat Buffet of Opportunity” for franchisors, with a never-ending parade of potential buyers. However, like every industry, franchising also has its finite available market (such as the total number of available franchise buyers) and a finite number of companies this demand will support. And when supply drastically exceeds demand, markets disrupt. Assuming franchise candidates don’t really want to invest in struggling and cash-strapped brands with little staying power (which, again, FPG would say are stagnant franchisors operating under 100 operating territories), then the current pool of franchise candidates can only really support about 1,000 brands, unless these brands can significantly drive income from other sources such as company store operations. If our estimates are correct, this leaves up to 80% of the current franchisors at risk.

Decrease in new business starts. The 2015 U.S. Census, which is the latest information available, reported 414,000 new business starts, the lowest total in 40 years. This represents a steep 10% decline from 2014 data, which showed slightly over 450,000 new business starts. To put this in perspective, over the previous 40 years, U.S. Census measured new business starts to hover between 500,000-600,000 each year.

Since this Census report was published, unemployment has significantly declined to about 4.1%, which is basically a full employment economy. When the job market and stock market are strong, many would-be first-time business owners stay in the job market and keep their money in stocks. FPG predicts new business starts to dip below 400,000 in 2018, creating new historic lows.

For other historic firsts, in its February 2017 white paper Dynamism in Retreat, Economic Innovation Group reported that since 2008, the number of business closures more or less equaled or exceeded start-ups, with the current trends moving towards consolidation. Their research concluded these trends were pervasive across industries and geographies, aligning microeconomic and macroeconomic trends. Their bottom line is we have entered into a previously uncharted market where people are more risk averse and less entrepreneurial than any other time in recent history.

Cost of business increases. With low unemployment comes wage increases. Higher wages lead to higher product and service costs that squeeze margins, particularly for companies who are low-cost providers or who operate in commoditized markets. They may find it difficult to pass their cost increases along to their customer base.

Over the last year the prime rate has increased .75%, leading to a higher cost of money. Again, companies may have a difficult time passing interest rate cost increases to the customer, thus eroding margins.

Franchisors currently operating at below 15% EBITDA may see their EBITDA percentage dip another 1-2 points, perhaps stunting growth by adding more perceived risk than their current crop of franchise candidates are willing to assume.

It is unwise for franchising to ignore these trends, thinking it operates under its own economic rules and is somehow unaffected by the broader economy. Given what FPG believes to be great disequilibrium in the franchise candidate demand/franchisor supply curve, we expect to see more consolidation among franchisors.

Strong Economy Will Lead to Stronger Unit-Level Economics

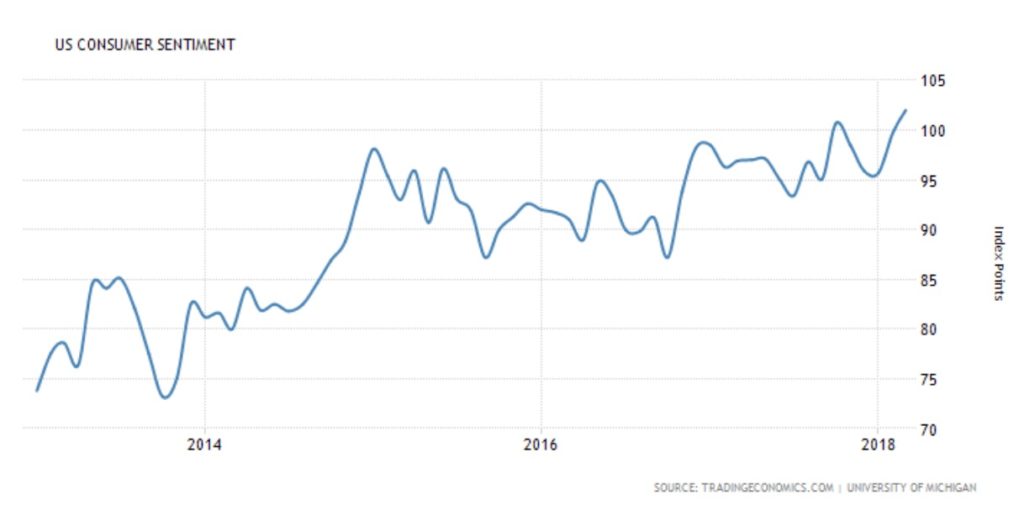

Unlike the 2008 market disruption, the economy appears strong with consumer confidence and GDP trending up.

This is fertile ground for franchisees to grow their businesses, resulting in potentially higher franchisor royalty collections for the most competitive brands. FPG expects to see strong year-over-year sales increases for existing franchisees of strong brands. Sales gains should improve franchisors’ unit-level economics and help franchisors tell a better story to their target franchise candidates. However, costs will continue to increase.

Market Opportunity

Franchise candidates don’t invest in “franchising” – they invest in individual brands. This means well-run and well-executed brands with profitable business models can and will buck larger microeconomic and macroeconomic trends. They aren’t necessarily tethered to franchising as a whole, unless they make the fatal mistake of thinking and acting just like other franchisors. As shown, brands who make that mistake run an 80% probability of stagnating before reaching a point of stability and sustainability.

Einstein once said, “We can’t solve problems using the same kind of thinking we used when we created them.” Along the same lines, I had a mentor who always used to say, “How you define the problem determines how you solve it.”

FPG predicts the current market disruption will lead to franchisor consolidation and shakeout. It’s imperative franchisors start thinking and acting differently now to survive. Like any business that executes the basics well during tough economic times, they capture a disproportionate share of the market as the market corrects and rebounds.

Smart and well-capitalized franchisors will spend the time, money, and energy to look, act, and operate like large national brands while still in the Early Stage and Emerging Growth stage of development. The time when unrefined franchisors could develop their model through trial and error using the royalty and franchise fee revenue dollars is over.

According to Google, 70% of the investment decision of high ticket-high engagement purchases (such as real estate, computers, and cars) is made through self-directed research. Franchise candidates will also take this course as more trustworthy information streams become available.

Those franchisors who don’t have the $1-2 million of investment necessary to perfect their model will most likely become the first casualties of market consolidation. These brands will either collapse, stagnate, or get picked up on the cheap by value-shopping private equity turnaround specialists or market consolidators.

The bottom line is this. Franchise candidates will be more educated and discerning and will invest in the unique, proven, profitable, replicable, predictable, and sustainable models they always thought they were joining in the first place. Any brand that isn’t that already, it’s time to up your game.

Join the New Franchising Thought Leaders LinkedIn Group

Join FPG’s moderated LinkedIn Group dedicated to forward-thinking franchisor professionals, franchisees, suppliers, private equity, lenders, and all students of the franchising industry.

Franchising Thought Leaders. No advertising. No personal agendas. Just “must-read” content, thoughtful discussion, case studies, and debate about franchising best practices and the future of franchising.

About FPG

FPG is a thought-leading management consulting firm specializing in franchising. We collectively have almost 100 years of experience working all aspects of the franchising ecosystem, such as franchisor executives, multi-unit franchisees, and suppliers to franchisors. FPG offers franchisors a proven business format and platform to successfully propel the brand from the Emerging Growth stage to Regional, National, and Iconic brand status. We also help turnaround brands resurge. FPG operates much like a franchisor, but without a specific brand.

www.FranchisePerformanceGroup.com

About Joe Mathews

Joe Mathews is founder of Franchise Performance Group and a student of national brand building that leverages franchising. Mathews has more than 30 years of franchise management and leadership experience with such national chains as Subway. He is a regular presenter at IFA conferences, and has served as an instructor with the ICFE (Institute of Certified Franchise Executives). He specializes in franchisee recruitment, franchise sales and franchisee performance. He is author/co-author of four books: Street Smart Franchising, Franchise Sales Tipping Point, Developing Peak Performing Franchisees, and How to Create a Franchise Sales Breakthrough. Guaranteed.

Joe Mathews is founder of Franchise Performance Group and a student of national brand building that leverages franchising. Mathews has more than 30 years of franchise management and leadership experience with such national chains as Subway. He is a regular presenter at IFA conferences, and has served as an instructor with the ICFE (Institute of Certified Franchise Executives). He specializes in franchisee recruitment, franchise sales and franchisee performance. He is author/co-author of four books: Street Smart Franchising, Franchise Sales Tipping Point, Developing Peak Performing Franchisees, and How to Create a Franchise Sales Breakthrough. Guaranteed.