By Joe Mathews, CEO of Franchise Performance Group

Recently we were back on the conference circuit, and the main question on everyone’s minds was: Is it over? When will franchise sales recover from the pandemic? Are we finally back to normal?

Fortunately we had lots of company. It was terrific to be at live conferences again. The IFPG national conference in Ft. Lauderdale was well-attended. The organizers of the Franchise Leadership and Development Conference put on a terrific two days of events in Atlanta. They reported attendance was above their last previous pre-pandemic event. Additionally, we worked with Keith Gerson at Franchise Update on a recent webinar discussing the results of their Q1 and Q2 Franchise Sales Index based on the aggregated lead generation and franchise sales data of 600 brands.

Here’s what we learned that will impact everyone’s lead generation and franchise sales strategies in the coming year.

Franchise Sales and Lead Generation Back to Pre-Covid Levels

FranConnect reported that aggregately, lead generation and franchise sales activity were back to pre-covid levels based on an analysis of 600 franchisors subscribing to their franchise sales CRM platform.

The 2021 numbers are based on 6-months of data (Jan-June) where 2020 was based on a full 12-months of data.

Reported deal flow may or may not include existing franchisees expanding. Having worked with dozens of brands on the FranConnect franchise sales CRM, FPG can safely say that some brands track existing franchisees who expand in FranConnect and some do not. We can also safely say that some brands are more rigorous in their data collection than others. So use this data as directional rather than absolute.

Larger Brands Rebound Best

| 2021 | ||||

| Brand Size | Micro-emerging

(under 11 units) |

Emerging

(11-75 units) |

Mid-Market

(76-200 units) |

Enterprise

(201+ units) |

| % of chains | 18% | 39% | 23% | 21% |

| % of lead flow (YOY% +/-) | 5% (-22%) | 21% (+41%) | 25% (+16%) | 49% (+18%) |

| % Deal Flow | 3.40% | 15.80% | 21.20% | 59.60% |

| Total # deals per category (Jan-June 2021) | 147 | 686 | 921 | 2592 |

| Projected # deals per brand 2021 | 3 deals | 6 deals | 14 deals | 41 deals |

| Lead to close | 0.75% | 0.80% | 0.90% | 1.30% |

| 2020 | ||||

| Size | Micro-emerging | Emerging | Mid Market | Enterprise |

| % of chains | 21% | 31.30% | 21.20% | 26.30% |

| % of lead flow | 8.40% | 24.90% | 27.90% | 65.20% |

| % Deal Flow | 3.50% | 13.70% | 19.70% | 63.10% |

| Estimated # deals per brand |

2 deals |

5.4 deals |

11.4 deals |

29.7 |

| Lead to close | 0.50% | 0.70% | 0.90% | 1.20% |

While only 21% of the chains represented, larger (Enterprise) brands represented almost 60% of all deals done. Franchise buyers clearly saw value in the perceived safety, security, proof of concept, and competitive resources of the larger enterprise brands. Combining the deal flow of both Enterprise and Mid-Market represented more than 80% of the total deal flow for both 2021 and 2020.

In 2021 Enterprise brands are growing at a projected rate of 41 deals per brand, up approximately 30 deals per year in 2020, a significant gain.

Mid-Market brands had a 14 deal per brand run rate for 2021, up from an estimated 11 deals per year in 2020, representing modest gains. Keep in mind these gains are not enough to catch the larger brands in size, revenues, marketshare, and earnings. Bigger brands are becoming more dominant and continue to pull away from their smaller competitors.

In 2021 Micro-emerging and Emerging brands are achieving estimated deal flow rates of 6 deals and 3 deals respectively, only slightly higher than 2020 rates.

To put this in perspective, FPG’s franchisor financial modeling shows on average, it takes at least 12 deals per year for a franchise sales department to break-even, meaning franchise fee revenue covers the operating costs of the franchise sales department, assuming the department can be managed with one full-time, experienced franchise salesperson, a marketing agency on retainer to manage advertising spend, and one fractional outside attorney to manage FDD-related issues. Therefore, Mid-Market franchise sales departments would be running near break-even and Micro-emerging and Emerging brands are most likely losing money to recruit franchisees, showing the competition for deal flow for the smaller brands is as fierce as ever and the franchise buyer demand for smaller brands remains weaker than these brands need demand to be to build vibrant and profitable franchise brands.

This further dispels the perpetual myth that franchisors can capitalize their companies on franchise fee revenue. Simply, the numbers clearly show something different.

Additionally, FPG franchisor financial models show that a typical franchisor does not achieve royalty self-sufficiency until it receives royalty contributions from 30-75 units or territories, depending on the average unit sales of the franchisees and the franchisor’s related cost of servicing franchisees. At an anemic 3-6 deals per year, franchisors need to find more and better ways to grow their chains by lowering costs, dramatically improving ROI, and driving unit-level economics. Smaller chains may be forced to open more company units to drive earning and enterprise value, build new markets, and protect core markets.

Franchisors often forget their franchise is an investment opportunity. Like any investment, the value or attractiveness to a franchise buyer ultimately depends on ramp up, ROI, predictability of a return, and projected long term sustainability of their returns.

New and smaller brands don’t have the proof of concept or ROI history other larger brands represent. Franchise buyers place a higher value on the track record of the larger brands than the wide-open markets and green spaces of the smaller brands. Franchise buyers perceive these brands to be higher risk and are rejecting their offerings as a general rule. The breakout Micro-emerging and Emerging brands are rare exceptions and not the rule.

Many investors historically accept higher risk as long as they project higher returns to offset the additional perceived risk. However, many smaller brands offer franchise buyers higher risk, lower returns, and are less predictable than their larger Mid-Market and Enterprise counterparts. That’s why franchise buyers are hesitant to jump in. They offer less value than their larger competitors at often the same cost of entry. These brands need to outperform their larger competitors or they must dramatically reduce upfront costs or find other ways to mitigate franchise candidates’ risk such as royalty incentives or performance guarantees to attract more candidates and close more deals.

PE firms and larger brands are now buying smaller brands to create a platform and make the necessary brand enhancements by injecting capital, skills, experience, and shared resources of the larger portfolio brand. This may create a halo effect, reducing the franchise buyers’ perceived risk and enhancing the franchisor’s value proposition.

There appears to be too many of these smaller brands than franchise buyers want to buy. The pandemic did not right-size what FPG believes and the data supports to be an over-supply of smaller brands.

When supply exceeds demand, economic theory 101 would state prices should go down to stimulate demand until supply and demand are at an equilibrium. However, franchisors as a general rule are not lowering upfront costs such as franchise fees or royalties. On the contrary, some brands are doubling fees to cover broker and Franchise Sales Organizations (FSO) commissions. These fee increases raise the entrepreneur’s break-even points, add unmitigated risk, and offer zero added value to the entrepreneur.

The marketplace for franchisees and franchisors to find each other is wildly inefficient at best and at worst adds unmitigated risk to the franchise candidate’s investments.

Lead generation inefficiencies

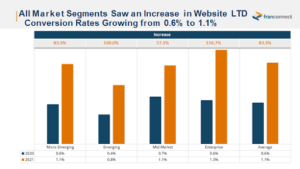

While the average lead-to-close ratio remains 1% in 2021, the numbers are skewed by the Enterprise brands who are closing at rate 40% higher than Mid-Market and 60% higher than Emerging brands. As you can also see, lead to close ratios are much higher for Enterprise brands (1.3%) than any of the other categories. Only Enterprise brands are closing at a rate above 1%. Again, enterprise brands achieve efficiency points smaller brands are not attaining.

While the Franchise Sales Index shows deal flow across the board is up 20%, Enterprise brands are the main beneficiary of the return of the franchise buyer.

FPG has long maintained that lead flow and deal flow is not a perfect positive relationship. In other words a chain can reduce lead flow and increase deal flow at the same time.

In 2021 the Franchise Sales Index showed the greatest sources lead flow often produced anemic deal flow. See below.

While a franchisor’s franchise opportunity website accounted for the number one source of deal flow, FPG’s data shows the franchise opportunity website to be far more critical to a franchisor’s recruitment results than this data shows. For instance, if a franchise buyer is referred to a brand by a franchisee, the buyer doesn’t immediately contact the recruiter. FPG’s research shows the buyer is engaged or disengaged based on the quality of the content on the brand’s franchise opportunity website and other brand story content streams. In other words, a well-constructed site and intelligent content strategy will increase deal flow generated by referrals and other sources. A referral lead will disengage if the content doesn’t adequately answer their preliminary questions and break down any barriers to conversation that may exist. The brand’s franchise opportunity website or landing pages ultimately drive the performance levels of all other sources such as social media advertising (Facebook and LinkedIn), cross-over traffic from the consumer site, PPC, SEO, and other sources of marketing. If the franchise opportunity website and corresponding content streams were hockey players, they would get credit for both goals and assists representing 80-90% of the franchisor’s total deal flow. Only some franchise broker deals and perhaps some portal advertising may bypass the brand’s franchise opportunity site and corresponding content streams.

Online and Digital Lead Generation and Web Traffic is

an Equalizer

Having a best-in-class franchise opportunity website is the best money a franchisor can spend in Q4 2021 to prepare for 2022. Regardless of the size of the brand, all but Emerging brands averaged a 1% close rate or higher for franchise candidates who sign the franchisor’s contact form. In other words, once a lead engaged in a brand’s franchise opportunity website, regardless of size, the results were the same. Content was an equalizer.

Lastly, paid advertising such as the social media search engine advertising listed above is not a commodity. The right copy, placement, tactics and strategy will produce far better results than if led by an unskilled practitioner. Because digital marketing is so complex, many franchisors make the strategic error of placing consumer marketers over the franchise sales advertising budgets, thinking “marketing is marketing.” FPG’s experience shows the same successful tactics companies use to drive customers to their franchisees often fail when applied to marketing their franchise investment opportunity. In other words marketing for franchisees is a distinct set of skills that consumer marketers may or may not possess.

Since it typically costs under $10,000 in advertising spend to recruit a franchisee, digital and content marketing represents more than 80% of deal flow, and smaller brands are closing these leads at the same rates of the larger brands, franchisors should align with skilled and experienced franchise candidate lead generators and maximize these opportunities.

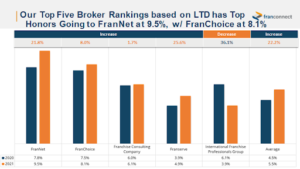

2021 is a Banner Year for Franchise Brokers

Franchise broker groups are having a stellar year. Franchise buyers are placing almost as much trust in broker referrals as they do customer or franchisee referrals, closing at a rate of 5% for the community and as high as 9% for FranNet. Broker deals represent about 16% of the deals done in this particular study.

Brokers represented slightly more than 16% of the almost 3,500 deals FranConnect tracked in the first half of 2021. The broker value proposition appeared enhanced by the pandemic. Buyers assumed brokers would know which brands showed increases and promise and which brands suffered, mitigating risk.

FPG clients have paid millions of dollars in broker commissions over the last 20 years so we are bullish on the broker channel. Brokers can significantly drive deal flow. It’s important to remember however the typical broker network does most of their deals at any point in time with only a small handful of brands. Unless a brand gets on the super-short list, a brand cannot rely solely on broker deal flow to materially drive franchise sales and do 20 franchisees or more. A brand may influence but cannot control what brokers show. Therefore the franchisor’s sales spigot may shut off at any time at no fault of the brand. Relying solely on broker networks to drive deal flow is a significant strategic error. FPG recommends a balanced approach starting with maximizing lower cost paid advertising opportunities and folding in brokers as an added resource.

Yes, it’s over, it was bad, and now it’s more of the same

The data FranConnect published suggests the franchise buying market is consistent with pre-pandemic levels. The data Franchise Leadership and Development Conference presented suggested the market is still slightly off but recovering quickly. So yes, it’s safe to assume the franchise buyer market is materially back and franchise sales have recovered for most brands with strong post-pandemic unit-level economics, with certain market exceptions like full-service restaurants.

While significantly disruptive, the pandemic was not the transformative event that would expand the number of franchise buyers or thin the oversupply of franchisors, thus improving the growth opportunities for smaller franchise brands. Given the data, the franchise buyer is still largely passing over the offers of most Micro-emerging and Emerging growth brands. These brands are going to need to find a way to improve unit-level economics, align with skilled franchisor suppliers to improve the franchisor bench strength and franchise offering, recapitalize their companies and invest more capital into looking, feeling and performing like their larger regional and national competitors in order to attract more franchisee talent. Additionally, smaller brands may need to incentivize franchisee talent to join their chain, realizing that the franchise candidate may offer more value to the brand than the brand offers the candidate. Larger brands will continue to benefit from efficiencies of scale and greater demand for their brand, creating more perceived value as they continue to distance themselves from their smaller competitors.