Over the last few months I’ve traveled thousands of miles, drunk way too much coffee, and participated in multiple franchising industry events. Having had the chance to talk to franchisor leadership, suppliers, lenders, and private equity before, during, and after the events, we discussed many opinions, concerns, trends and events that are impacting our franchising.

It’s becoming clear the franchising market disruption we predicted in July 2017 (see Is the Franchising Bubble Ready to Burst) is now impacting brands and lending to discussions and conversations on what is next for franchising. In this article we will flush out more about the current market conditions, detail possible near term implications, review potential outcomes, and discuss how brands should reposition in 2019. Additionally, I will provide some commentary on what I believe lies ahead for franchising.

“Full Employment” Economy

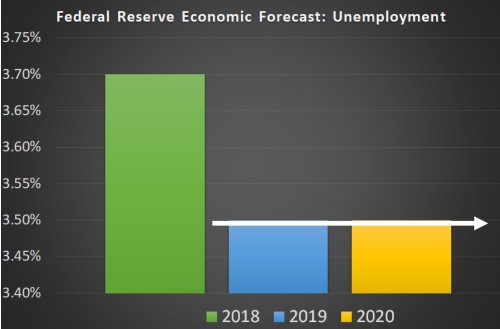

The Federal Reserve Economic Forecast projects that unemployment will decrease from an anticipated 2018 year end of 3.7% to 3.5% for 2019 and 2020.

Implications of Full Employment

In franchising a full-employment economy generally creates one potentially large economic benefit and three operational challenges.

On the benefit side, a full-employment economy often increases wages, which in turn increases discretionary income and consumer confidence, which increases consumer spending and leading to potential increases in franchisees’ and franchisors’ sales and profitability.

But it also creates operational challenges.

First, many new franchisees are first time entrepreneurs. In a stagnant economy or recession as unemployment rises, first time entrepreneurs often believe the job market looks risky and starting a business appears secure. In today’s strong job market where wages are increasing and advancement opportunities are plentiful (even if it requires people to change companies and relocate), those same first time entrepreneurs view the job market as secure and starting a business looks risky. While they may still investigate different brands to keep the dream of entrepreneurship alive, many will resist pulling the trigger as they compare franchising to their career opportunity options. This dynamic can lead to an increase in lead generation numbers, but predictably the number of franchisees a franchisor recruits may decrease due to high perceived job market opportunity cost. The impact of this slow down in franchisor’s growth who count on recruiting first time entrepreneurs can lead to slower than expected earnings growth and cash flow.

Second, the franchisees labor cost may increase as they struggle to find responsible labor. Franchisees are less likely to expand in markets when they can’t readily find labor. This hurts franchisors’ prospects for organic growth and new revenue streams from its most cost effective and lowest risk resource, successful franchisees.

Lastly, these wage increases often cannot entirely be passed on to the customer in the form of price increases, resulting in a decrease in the franchisees’ EBITDA, and weakening unit level economics. These market dynamics make it harder for franchisors to recruit new franchisees as unit-level economics may suffer.

In 2019, franchisors who understand these dynamics will integrate becoming an “employer of choice” to their strategic plan and fund initiatives to help franchisees attract and retain talented individuals from thinning labor pool.

2% Inflation

This is inline with the Fed’s target of 2% inflation, which theoretically means room for franchisees to take modest price increases and thus incentives for consumers to spend now, growing revenues and creating job opportunities. However, this also allows for the Feds to raise interest rates.

Implications

Many franchise systems are already experiencing an increase in their cost of labor and COGS (cost of goods sold), putting downward pressure on margins. Layering a higher cost of money places additional pressure on the system’s unit-level economics, adding risk and possible disincentives for existing franchisees to expand and new franchise candidates to invest. This may tighten an already competitive market for recruiting new franchisees.

In 2019 franchisors will need to maniacally focus on franchisees’ profitability. They will dissect their entire revenue model and will begin initiatives to simultaneously drive new customer growth, increase average ticket, increase customer frequency, and extend the lifetime value of the customer as well as create and perfect recurring revenue models for franchisees.

Brands will look to build exclusive strategic lending relationships with banks, fleet leasing companies, and other financial institutions to gain access to start up and expansion capital, securing liquidity for their system.

Slowing “Across the Board” Franchise Unit Growth

At the 2018 Franchise Sales and Leadership Conference FRANdata presented new unit count annual growth rate of 2.7%. FRANdata compared this to over 4% prior to the financial crisis. This slowdown is predictable given current market conditions and will continue to be slow into the foreseeable future.

FRANdata reported slightly over 27,000 new franchise openings in 2017, up slightly from 2015 and 2016 totals of over 26,000. FRANdata didn’t report how the growth numbers broke down between existing franchisees expanding and new franchisees opening. If you assume 50% of the growth came from franchisee expansions and 50% from new franchisees, that means the total number of new franchisees entering the market from all systems FRANdata tracks would be under 14,000. This total for new franchisees entering the market is not enough to support the nearly 4,000 franchisors and 300 new concepts that enter the marketplace each year.

Implications

Many franchisors will not hit their 2018 and 2019 growth objectives. These franchisors will be under intense financial pressure to create new revenue sources. Since almost all new franchisor revenue sources decrease franchisees’ profitability (such as capturing rebates from franchisees’ purchases, increasing technology fees, etc.), franchisees may start to feel squeezed as their costs of doing business rise. As financial pressures impact the entire system, franchisee-franchisor relations may strain for a period of time, often leading to negative franchisee validation. This in turn will make it difficult for these systems to attract new franchisee talent and create new sources of royalty revenue, possibly creating a downward cycle.

In 2019 forward-thinking franchisors will show great financial discipline and will will resist the urge to place additional financial pressure on franchisees by raising fees. Franchisors will instead look to l fund initiatives which will grow franchisees’ margins or ease franchisees’ operational burdens, making them expansion ready so franchisors can realize new royalty revenue streams. Smart franchisors know that franchisees will continue to expand when they have confidence in their model and have a clear line of sight to achieving their financial objectives. Many franchisors will offer strong financial incentives (such as reduced royalty rates for up to 3 years) for skilled franchisees who wish to expand, offsetting rising operating costs with these rebates.. As the market continues to tighten, franchisors will become less rigid with royalty payments during the critical launch stage of the franchisees’ business start measuring ROI and factoring equity appreciation of these proposed royalty rebates. as the market tightens.

Suppliers as Strategic Profitability Partners

Historically, many suppliers experienced difficulty cracking the code of how to do business with franchisors. Forward-thinking suppliers and franchisors will work together in key strategic partnerships to drive franchisees’ costs down and simplify operations in the near term for the long term payout of exclusive or semi-exclusive relationships. Additionally, franchisors will elevate key vendors to the VP and C-level and develop plans to stabilize franchisees’ businesses in this disruptive and competitive market. They will evaluate vendors based on their total added value rather than simply “who provides the lowest price.”

SNO in the Forecast (Sold Not Open)

FRANdata reported in 2015 slightly less than 21,000 franchisees invested in franchises, but did not open. In 2017 the number increased to almost 23,000. FPG attributes this partly to overly aggressive franchise salespeople combined with weaker than expected franchisees’ returns due to previously discussed market forces.

Implications

Lenders and private equity are looking closely at SNO as a lead indicator and predictor of a franchisor’s sustainability. Franchisors with high SNO will find it difficult to get franchisees financing, placing additional pressure on openings, creating a vicious cycle of more SNO. Private equity will discount the franchisor’s enterprise value because these territories are off the table, not being developed, and therefore can’t be monetized.

Franchisors will understand that units sold and not open is a liability rather than an asset. The high value Franchise Development Manager of the future will be a true “development manager” rather than a “salesperson.” As a development manager, they will help multi-unit franchisees develop a capitalization, staffing, and organizational development plans which support the development plan. Franchisors may offer financing incentives to help franchisees “over staff” their existing operations to make them expansion ready, opening new units and territories with battle-tested and proven staff, easing operations and accelerating new units or territories past their break-even points.

Disequilibrium in the Franchisor Supply and Demand Curve

Keep in mind there are now approximately 4,000 franchisors competing for 14,000 franchise candidates. If this wasn’t competitive enough, also consider over the last several years, FRANdata reported 300 or more new concepts have entered the market each year. New concepts mostly dilute the existing available market rather than expanding it.

FPG franchisor proformas show that a typical franchisor achieves royalty self-sufficiency about 50 units or territories, with a range of 40-100 units or territories depending on a particular franchisor’s economics. In 2017 FRANdata reported 82% of franchisor brands had less than 100 units/territories. This means most franchisors are not yet sustainable and the current available market is too small for the existing crop of franchisors to achieve long term sustainability. Assuming the market doesn’t change, any franchisor starting today may take 10-20 years to achieve royalty self-sufficiency. Imagine if your consumer-facing model took 10 years to break even. How much interest would you generate?

The good news is franchisee investors don’t buy a “typical franchisor” or “franchising in general.” They invest in a specific brand. The market always makes room for a unique, profitable, scalable, and sustainable business model with high barriers of entry, run by an experienced and well capitalized executive team.

But shouldn’t that describe every franchise brand in franchising?

Are Americans Less Entrepreneurial Than Before?

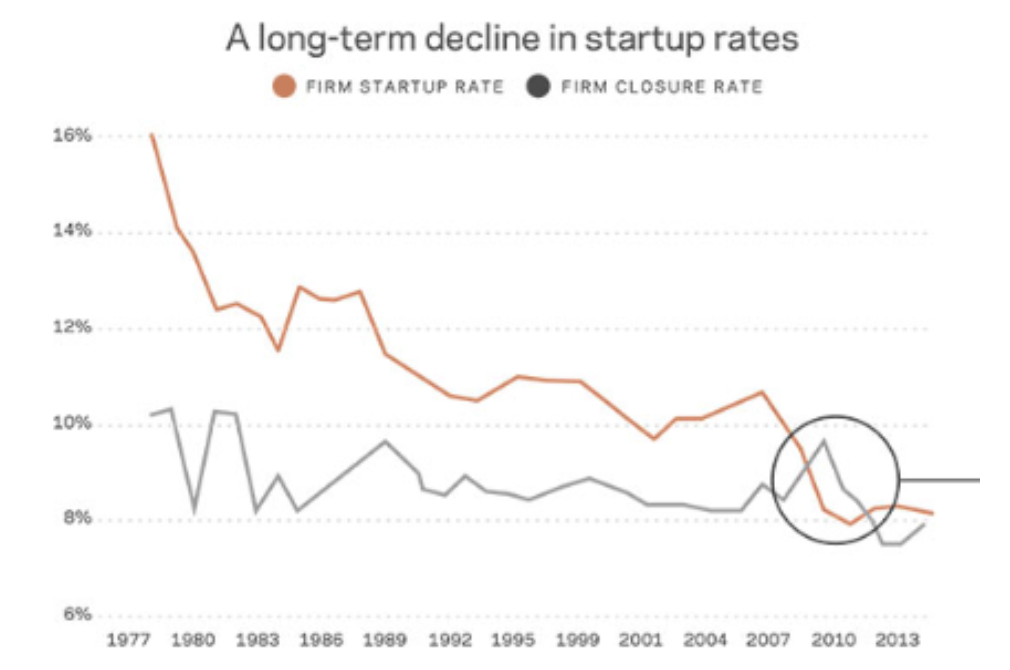

According to Economic Innovation Group, over the last 8 years, the number of business closures more or less equaled the number of new business start ups.

The US Census Bureau reported a total of 414,000 new business starts in 2015, the latest available data. In 2014 the number was about 453,000. In a full employment economy, many would-be first time entrepreneurs pursue opportunities in the job market In any given year over the previous 40 years, Americans started 500,000-600,000 new businesses. In 2015 only about 6% of new business start ups were franchises. In a full employment economy, many would-be first time entrepreneurs pursue opportunities in the job market. Therefore, FPG predicts the 2016-2018 new business starts to be under 400,000.

Implications

Franchisors will look at new and innovative ways to attract the roughly 94% of people who don’t see traditional franchising as a viable self employment option. This may lead franchisors to invent more “shared risk” or “operating partnership” type models and offer new franchisees aggressive incentives to join and existing franchisees to expand.

Some franchisors will experiment with models such as Chick-Fil-A and Christian Brothers Automotive, which pay entrepreneurs a salary or draw, offering many of the benefits of self employment without some corresponding risk.

FPG recommends the IFA sponsor an exploratory committee of visionary franchisor executives and suppliers to rethink traditional franchising and identify changes and shifts in thinking which need to occur to create new and profitable entrepreneurial offerings which attract the 400,000 entrepreneurs who don’t yet see franchising as a viable entrepreneurial option.

Going back to the equilibrium between new business start ups and closures, since the economy is growing, revenue increases are largely being shared by existing businesses and not diluted over new business start ups. In the short run, this will help more existing businesses be profitable. According to the SBA, small business account for almost 64% of new private sector jobs. Eventually this lack of new startups will contribute to higher unemployment and a slowdown in the economy. This leads companies to layoff and downsize, which in turn leads displaced employees and executives to invest in more franchise and other new business start-ups. Franchising has a tendency to see increases in economic slowdowns and other companies flatten or decrease.

Private equity will continue to invest in franchisors because franchisors provide the investment fund a counterbalance and risk mitigator for their other portfolio companies who would tend to decline as the market declines.

The Impact of Private Equity

Private equity has been highly active within franchising, aggressively purchasing regional and national brands. The low cost of money combined with the competition for unique, profitable, and sustainable brands created a premium exit for worthy brands. This is altering how franchisors’ ownership is thinking about their business. For instance, one of the major themes of the forward thinking emerging growth franchisor event centered around gaining a double-digit EBITDA multiple enterprise value.

Private equity looks at franchising differently and values different things than franchisors. For instance, I was at an event where the franchisor’s franchise development executives were sharing their development results. In this situation they sold franchisees large, multi-unit development agreements and sold out large territories.

On a recent panel consisting of active private equity firms with a franchising focus, the panelists made the point that statistically speaking most of these units will never open. Since these franchisors offer exclusive territories, this prohibits the territory from monetizing, hurting revenue and profitability growth and therefore private equity group’s chances of driving equity growth. They said they discount the enterprise value of franchise brands who engage in this practice. They also apply little equity value to franchise fee revenue because franchise fees are not a recurring revenue source. So these franchise development executives who believe they were adding value with their accomplishments in actuality were being subtractive.

Implications

Private equity will continue to disrupt franchising in many of the following ways:

- Professionalizing franchising. To aggressively grow any brand, private equity understands brands need to have a unique, high value, and profitable customer offering, high barriers to entry, clear competitive advantages in the marketplace, and long term sustainability. These are basic business fundamentals. Many franchisors however are copycat concepts which are largely undifferentiated in the marketplace. Private equity knows this leads to commoditization which in turn leads to downward pressure on sales and margins and lower profits. Private equity will make strategic reinvestments in portfolio brands to elevate their position in the marketplace and drive results. This sudden increase in highly resourced and professional competition will push other brands to elevate also, creating better execution and creating higher value offerings to customers.

- Intense increase in competition. Imagine what would happen to your brand if one day you woke up and you learned your closest competitor now has tens or hundreds of millions of dollars in backing and access to top minds in strategy, sales, marketing, operations, and finance. Private equity invests in brands to aggressively grow earnings and enterprise value over a typical 5-7 year window. In a zero sum game, that means these private equity backed brands are going after your franchisees’ customers and the livelihood of your brand.

- Franchisor consolidation. Weak, copycat brands with no defensible position in the marketplace will be acquired at a highly discounted enterprise value by the private equity-backed market leaders and then rebranded.

- Competition for skilled executives and franchising domain expertise. Private equity is beginning to understand franchising is a business unto itself. At closing, many private equity firms think they bought a consumer-facing business. After some time in business, they find out they are in the business of franchising, a business they and the brand’s leadership teams often know little about. This creates high demand for executives and consulting firms with a strong franchising track record and franchising domain area expertise.

- Designing the brand for an exit. Inspired by the premiums paid by private equity, Early Stage and Emerging Growth Franchisors will take on more financial backing and make strategic investments earlier in their lifecycle. Smart franchisors will start to look, feel, and act like large national brands while still in the Early and Emerging Growth stages. Expect to see more “franchisee roll up clauses” in the franchise agreements allowing franchisors to essentially buy their franchisees’ earnings at a premium price, such as 6-8X EBITDA, which represents 100% premium over the typical 2-4X EBITDA most small businesses sell for. This allows franchisors to more quickly accelerate towards the $5-10M in EBITDA which has been attracting 10-15X EBITDA valuation by private equity. This aligns franchisees and franchisors’ interests and allows franchisees to participate in the increase in enterprise value they helped create with their franchise.

Conclusion

2019 will be known as the year franchising professionalizes. The competition for new franchisees has never been more competitive. Undercapitalized and unskilled franchisors with poor brand differentiation will be acquired by stronger brands or driven out of franchising or out of business by higher value brands with greater skills and financial resources.

This hypercompetitive market will lead to greater professionalism in franchising and franchisors and private equity to place a high value on skilled executives and consulting firms with strong track records and franchising domain area experience.

Forward-thinking franchisors will create new and more innovative offerings which better align franchisees and franchisors risk and reward, and reduce the franchisees’ cost of entry.

Franchisors will find new and more innovative ways and craft different offerings to attract new franchisee talent who normally would not consider investing in a franchise, allowing franchisors to find exclusive pockets of potential franchisees to recruit from the broader franchisor market can’t reach.

Franchisors know both franchise candidates and private equity investors will always seek out and invest in a strong brand with solid business fundamentals and high growth potential. These franchisors will make the investments necessary to drive franchisees’ unit level economics which in turn fuels their growth and ultimately their enterprise value. These franchisors will take on a new perspective, creating worthy brands customers, franchisees, suppliers, and private equity would see as high value and aspire to align with.

The era where the market propped up mediocre, undercapitalized, copycat brands with no defensible position in the marketplace is over.

Lastly, the era of the market paying upper six figures for franchise executives, franchise salespeople, or consulting firms who have not kept up and stayed current with market changes and marketplace demands is also over. The market will continue to reward impact players who can carry a brand forward, building sales, profitability, sustainable growth, and enterprise value on the strength of their experience.

About Joe Mathews

In 2002, Mathews founded Franchise Performance Group to study how to use franchising as a strategy to grow iconic brands. Mathews has since written four books on franchising: Amazon.com best-seller Street Smart Franchising, The Franchise Sales Tipping Point, Developing Peak Performing Franchisees and How to Create a Franchise Sales Breakthrough. Guaranteed. He has also written or was featured in about 70 articles on franchising which appeared in such publications as USA Today, Fortune, Businessweek, Working Woman, Wall Street Journal, Southwest Airlines Magazine, Entrepreneur, Franchise World, Franchise Times, Franchise Update and other publications.

In addition to publishing, Mathews wrote and taught two ICFE classes and co-wrote the ICFE study guide section on franchise sales and lead generation.

You can contact Joe by completing the form in the footer of this page.