Disruption is the New Normal

By Joe Mathews

Founder and CEO, Franchise Performance Group (FPG)

In 2018, franchisors and brokers will continue to experience a disruption in their ability to recruit a steady stream of quality franchise candidates with the skills, background, capital, and experience to drive the brand.

This market disruption, caused by multiple limiting factors working in sync, leads FPG to believe market dynamics will only become more pronounced over the next 3 years. In no particular order, these factors are:

- Oversaturation of franchisors. Research firm FRANdata reports there are about 3800 franchise brands in the United States, at or near a record high for franchising.

- There are few new franchise candidates entering the market. FPG and FRANdata estimate that in any given year, only 13,000-20,000 franchise candidates invest in new franchises.

- Hundreds of new concepts consistently enter the market. In any given year, 250 to 350 new concepts choose to franchise, adding more noise to a crowded marketplace. Most new concepts do not add new buyers; instead, they dilute the available market and disrupt the demand/supply curve.

- Decrease in new business starts. The 2015 U.S. Census, which is the latest information available, reported 414,000 new business starts, the lowest total in 40 years and down 10% from 2014. Since this report, unemployment has declined another 30%, leading FPG to believe business starts are continuing to decline.

- Lower unemployment leading to lower risk tolerance. When the U.S. Census reported their data in 2015, unemployment was about 6%. The Bureau of Labor Statistics reported October 2017 unemployment was at 4.1%, the lowest in almost 10 years. When unemployment is high, starting a business looks more secure than the job market, but when it’s low, the job market looks more secure than starting a business. FPG behavior profiles show that more than 40% of the general U.S. population are primarily motivated by safety, stability, and security, rather than other drives such as independence and control.

- The surging stock market outperforms the financial returns of most franchise opportunities. When the stock market surges, franchise candidates have higher opportunity cost with lower perceived risk. Many resist pulling funds out to start a business because of the high perceived opportunity cost of money. High consumer confidence and robust job growth numbers will lead many investors to believe record stock market highs will continue, creating more resistance to using these funds in perceived higher risk ventures. Some, however, will take the gains, feel like they are playing with “house money” and take on more risk. These are not generally the most sophisticated franchise investors.

- Disruption in the franchise broker community. Many hundreds (if not thousands) of unqualified people are taking advantage of the low barriers to becoming a “franchise consultant,” confusing and deterring potential buyers.

- Weak recruitment talent pool. Over the years, many of the most productive franchisee recruiters entered the franchise brokerage space, leaving a shortage of impact players. Many unskilled recruiters only stay with a concept 2-3 years, harvest easy sales, then jump to another brand when the pickings get slim. FPG believes that career recruitment professionals have not kept up with changing franchise buyer behavior and operate behind the curve. Many haven’t sharpened their skills or altered their tactics to be consistent with how buyers buy. When sellers don’t sell consistently with the way buyers buy, deals don’t happen.

FPG’s Official Forecast for 2018

It’s tough out there. And will probably get tougher over the next 3 years.

Here is how FPG is responding to these increasingly competitive market conditions.

Please keep in mind these tactics will only work for brands that meet or exceed their franchise candidate’s financial and quality-of-life objectives. Brands also have to continue to foster trusting and workable franchisee-franchisor relationships.

If your brand lacks these, it is fractured at the core and a turnaround strategy is required. In a turnaround situation, franchisee recruitment results are the first to decrease and the last to come back. Qualified candidates will continue to bypass your opportunity until your brand drives unit-level economics, engages franchisees in the brand vision, and provides more skilled leadership.

Franchise Buyer Lead Generation Requires More Skills

FPG defines lead generation as “intersecting buyers who are actively seeking for what the franchisor is offering at their point of interest.”

All potential buyers explore, validate, and eliminate franchisor options by conducting research on the web and through other sources. The 2016 Synchrony Financial Major Purchase Study showed that for any consumer purchase over $500, 85% of buyers start the buying process with online research to explore and eliminate options. According to The Principles of Marketing, high-risk, high-involvement purchases (such as a house or car) create a higher demand threshold for information before they will engage the seller, translating into extended online research periods.

The new franchise marketing challenge is “How do I effectively work qualified leads who won’t talk to me?”

Smart franchisors will pivot and provide highly detailed investment and brand strategy information through online content, rather than try to force buyers to engage in conversations they simply aren’t willing to have.

Franchisors have an opportunity to break their dependency on portals and brokers with intelligent PPC/SEO, content creation and by applying a better understanding of who, why, and how franchise candidates make investment decisions.

On behalf of its clients, FPG responded to this buyer behavior shift by creating a strong bench of digital marketing experts with leading expository content creation skills. It’s the content team’s job to work with FPG franchisee recruitment strategists to create a rich multimedia brand experience which explains what makes the franchise opportunity…

- Unique

- Profitable

- Necessary to the customer

- Defensible/difficult to copy

- Sustainable for the long haul

- Worthy of investment dollars (ROI)

It’s the digital marketing team’s job to make sure this content intersects qualified franchise buyers at their point of interest.

Notice we said content needs to be “expository.” Candidates want to be educated and informed, they don’t want to be entertained or sold. They expect the information to support, challenge, or influence their brand perceptions. They want a brand that shoots straight rather than one that sugar coats or flat-out fabricates what it is.

Franchise Buyer Generation is “Skills Game,” Not a “Numbers Game”

Many FPG clients reduce lead flow, yet increase deal flow. For example, in 2016, FPG client College Hunks reduced lead flow by 8% but increased deal flow 50% through refinements in the brand story, recruiter skill development, and an enhanced digital marketing strategy. Lead generation is a simple numbers game. Buyer generation requires skills and strategy.

Consumer marketing experts and PR firms who have no experience working in the process with franchise buyers will become less effective in their lead-generation role as the franchisee recruitment process collapses on itself and becomes more self-directed.

To add an additional layer of franchisee recruitment domain area expertise, FPG brings in former franchise development executives and former multi-unit franchisees to work with our content design team and digital marketing experts to create strategy, improve messaging and “speak the language” of the franchisor’s targeted franchisee profile.

Your Franchise Opportunity Website Is Now Your First Critical Conversation With Your Candidate

Content streams continue to replace conversations. Therefore, FPG believes your franchise opportunity website and lead-nurturing content streams are now the most important tools in your recruitment tool box. Like any recruiter, your website and collateral content streams either engage buyers by answering their questions and satisfying their demand for trustworthy information, or they drive them away to other franchisors who do. It’s actively working for you or against you.

Your website should be producing the following results:

- 2.5% conversion rate or better on both mobile and desktop platforms

- 8-10% of these leads should translate into applications

- 1-2% of these leads should become franchisees

Now about 50% of candidates come in through a mobile device, up from roughly 20% a few years ago. This has significant design implications. The trajectory leads us to believe perhaps 80% of franchise buyers may come through mobile devices within the next 3 years.

Anticipating this shift, FPG now designs franchise opportunity websites with a “mobile first” design strategy meaning more video, shorter and more hard-hitting content, and more infographics. If your website was not designed with a mobile-first design strategy, it’s probably obsolete and needs to be reinvented.

Lead-Nurturing Content for Self-Directed Research

Harvard Business Review recently published an article which showed that online research takes up 70% of the time a car buyer spends determining which car to buy.

A recent study showed that renters whose social network consisted of homeowners in markets with strong real estate appreciation were far more likely to make an investment in a home, buy a more expensive home, and put more money down.

When purchasing a home, Zillow reports Millennials made their investment decisions based on information they gathered from three sources: online research, professional real estate agents, and their trusted online and local networks. According to the same report, 58% of Millennials said their personal network influenced their residential real estate purchase decision compared to only 42% of Baby Boomers.

Franchisors need to get influential and reliable franchise opportunity information and content into the hands of their target franchise candidate or into the hands of their personal network.

More of a franchisor’s advertising budget will need to be allocated towards content creation rather than advertising for leads, because that is what franchise buyers demand.

Maximizing Your Franchisee Recruitment Talent

Notice we said, “talent” and not “experience.” By confusing “years of experience” with “talent and ability,” franchising has created an entire community of franchise sales professionals who trade what FPG believes to be irrelevant past experience and successes as current and relevant in today’s dynamic, competitive marketplace. They often stay with a brand 2-3 years, pick off a few easy sales, and then try their luck with another brand. And the franchisor hiring them hopes they will be more effective than the last one. Each depends on hope, as if hope is a proven franchisee recruitment strategy.

Franchisors should abandon hope as a strategy and engage executives who understand brand strategy, buying trends, the value of data-based decision making, and how to create a breakthrough.

Too many recruiters have not kept pace with changes and simply do not know how to recruit in today’s environment or work with self-directed buyers. They say things like, “Just get me a qualified lead and I will close them,” assuming their job description has nothing to do with the lead-generation and lead-nurturing tactics required to “get me a qualified lead.”

Franchising seems to have created and sustained a large community of recruiters who depend on the strength of the brand to get deals across the finish line, rather than on their own skills and abilities. The market is light on impact players who can create a breakthrough and march the brand downfield on their shoulders. The market needs more strategists and skilled practitioners that can carry a brand. It’s plagued with a community of low-value-add recruiters the brand needs to carry.

The franchisee recruiter of the future will need to understand digital marketing, social networks, content creation, and executive recruitment techniques. They will need to align franchisee recruitment strategy with brand strategy. At a recent recruitment event, one presenter showed that more than 90% of multi-unit franchisees fall behind their development schedule. Why? Because franchisee recruiters do not understand how to marry a capital plan, real estate development strategy, and organizational development plan into one workable plan. They just close “3- and 5-packs,” with no accountability as to whether or not franchisees have the capital plan, organization, experience, and capacity to fulfill their obligations.

Franchisors need to place a higher premium on executives who think strategically and know how to build a cohesive team of expansion-minded franchisees who can execute the CEO’s brand strategy, and become less reliant on the experience of old-school salespeople who simply jam deals through.

In 2018, FPG is reorganizing its franchisee recruitment team to focus its most experienced and seasoned deal makers on the back end of the pipeline.

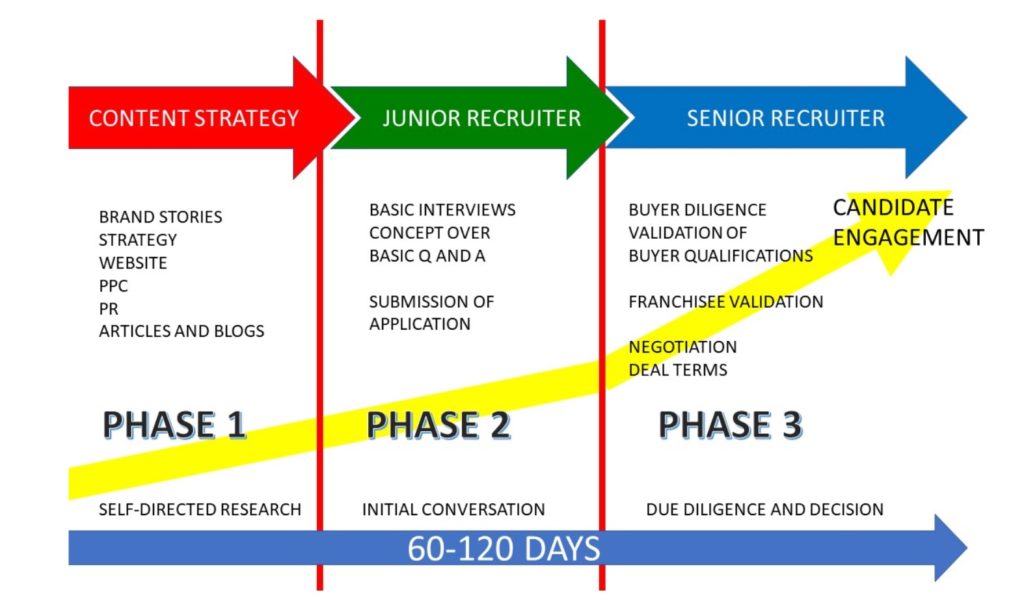

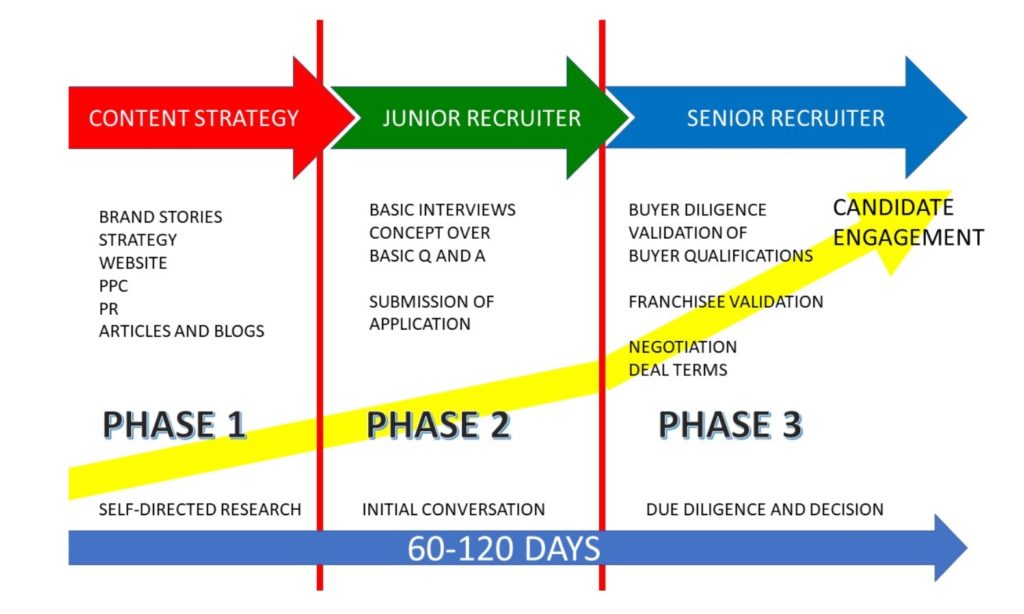

The average franchise candidate spends an additional 60-120 days investigating a franchise once they exit the “self-directed research” phase. FPG breaks down the franchise buying cycle into 3 basic phases.

- Self-directed research (franchise website, PR, online content streams, etc.)

- Initial conversations and information gathering (from Initial Inquiry to Application Received)

- Due diligence, validation, and decision-making (from FDD through franchisee validation, Discovery Day, and final decision)

In FPG’s new recruitment process design, the franchise candidate first engages a recruitment team member in Phase 2.

Phase 2 is very predictable. Prior to receiving the FDD, a typical candidate asks the same basic questions and wants the same basic information, regardless of deal size, industry, or investment level. A less-experienced recruiter can easily be trained to match the performance of a recruitment expert during these first few steps. FPG calls Phase 2 “The Science of the Deal” because the first few steps can successfully be implemented in a formulaic manner, supplemented with smart content to aid the less-experienced recruiter.

Phase 3 is where an expert recruiter’s skills pay high dividends. FPG calls Phase 3 “The Art of the Deal.” Skilled recruiters ask probing questions to uncover and correct misinformation and bad assumptions, assuage fears, and satisfy concerns. They hold candidates accountable for staying engaged and fact-check feedback. They know how to weave in franchisee validation, incorporate accountant and attorney feedback, secure financing, and book Discovery Day travel in a nonlinear but organized manner.

They can think strategically and help a franchise candidate create an integrated development plan to penetrate, staff, finance, market, and develop a territory.

Under the old structure, a franchisee recruiter will take a lead from initial inquiry to close, managing every step of the process, including time-consuming prequalification. Each month, a typical recruiter would expect to be able to achieve the following:

- Prequalify 150 leads

- Generate 10-15 applications

- Manage an active pipeline of 20-25 franchise candidates

- Close 1-2 deals per month

More than 70% of a recruiter’s time is spent on the inefficient and volatile front end of the pipeline, not on deal-making with engaged and qualified franchise candidates.

Under FPG’s approach, the candidate doesn’t engage a senior recruiter unless they apply for the franchise and are fully vetted. This process resembles the same interview process a candidate would partake if they applied for a key management position. They would interview and dialogue with multiple interviewers. Each would evaluate and sign off on the candidate, and then pass them off to someone higher in the organization with more decision-making authority.

Under this new structure, a senior recruiter only works 10-30 applicants per month. The increased bandwidth will allow them to be able to close up to 3-4 deals per month, or more than 40 deals in a year.

Having worked with over 110 brands over the last 15 years, FPG has determined that an expert recruiter will generally outperform a marginal recruiter by 200-300% with the same lead flow.

By focusing a skilled recruiter specifically in the back end of the pipeline where their skills make the most difference, franchisors should create more opportunities for franchisee recruitment success. In addition, the skilled recruiters will give up the repetitive tasks and conversations that often lead to burnout, which reduces flight risk and allows for greater income potential.

Outsourcing and Fractional Leadership

While 2018 is shaping up as one of the most competitive markets for recruiting franchisees in my 32-year career, franchisors can help their own cause by refining their brands and systems to create predictably stellar unit-level economics and trusting franchisee-franchisor relationships. Simply put, brands need to master the business of franchising and create the brand that others are already looking for.

Too many franchisors don’t want to invest the time, resources, and heavy lifting it takes to create pull demand and thus slug it out in a noisy, competitive, and commoditized marketplace of marginal brands and opportunities.

For those that have the desire, many lack the capital and experience to create an aspirational brand. They need the experience and skills of executives and thought leaders who have led brands to breakthroughs, but this doesn’t come cheap. Once a breakthrough is achieved, systems are designed, and people are trained to support the breakthrough, franchisors don’t need to carry the holding costs of such experienced executives indefinitely. While few people in the field can design and achieve a breakthrough, many more can manage the organizational breakthroughs the thought leaders create.

For instance, FPG typically takes 2-3 years to design, achieve, and then sustain a breakthrough in franchisee recruitment results. FPG will usually work with a client for 2-3 years and then hand the functions off to its replacements to manage “the new normal” of accelerated results.

It’s in the best interest of both the highly experienced, talented thought leaders and franchisors that they come together on a fractional or short-term basis. An emerging growth franchisor may not need their full time and best efforts. The thought leader may want to diversify their income and risk over a few emerging growth brands.

For instance, FPG offers clients fractional leadership and advisory services to assist the CDO, VP of Franchise Development, CFO, and CEO. FPG executives also assume the VP of Franchise Development and CDO roles for several brands. This allows franchisors to benefit from best-in-class strategy and execution without having to pay the full freight.

2019 Predictions and Beyond

In any market where supply exceeds demand, prices go down and providers seek to expand the market and protect operating margins. Most franchisors have not yet responded with more aggressive franchise offers or by creating “hybrid” models such as operating partnerships where the franchisors accept more financial and real estate risk and take their margin in operating profits rather than royalties.

Out of 450,000 new business starts in 2014, FPG and FRANdata estimate 3-4% were new franchisees. In 2019 and beyond, franchisors will begin offering more models to appeal to the estimated 96% of entrepreneurs who reject franchising as a viable self-employment or investment option.

Until then, franchisors will face a hyper-competitive and inefficient marketplace, competing for the 3-4% of franchise candidates who historically have invested in a franchise.

The market will continue to reward sophisticated franchisors with strong unit-level economics and a sustainable, defensible business model who are led by sophisticated, experienced, and franchisee-friendly leadership.

These breakout franchisors will be self-evident and obvious to both the customer and franchise investor. The concepts will look, feel, and deliver the customer experience and financial returns of a mature 500-1,000 unit brand at only 30-50 units, then simply and naturally grow into their capacity. Smart franchisors will make these investments upfront knowing “Sometimes you have to go slow to go fast.”

Franchise buyers will continue to become more educated and sophisticated on what sustainable and defensible franchise models look like, materially following the similar buyer behavior patterns of the real estate and automobile industries. These investors will reward skilled franchisors with their investment dollars.

FPG expects fewer new franchisors to enter the market as the new franchisors become more educated on what it takes to succeed. Many will elect to become more dominant and more centralized regional brands, realizing that a 30-unit centralized chain will most likely be more profitable, easier to manage, and carry a higher market value than a 100-unit franchisor.

About FPG

FPG is a thought-leading specialty consulting firm helping franchisors achieve breakthroughs in franchisee recruitment results. We collectively have almost 100 years of franchising experience as executives, multi-unit franchisees, and suppliers to franchisors. Since our inception, we’ve worked with 110 emerging growth, regional, national, and resurgent brands including Arby’s, A&W, BrightStar Care, College Hunks Hauling Junk and Moving, Huddle House, Chem-Dry, Taco John’s, Great Clips, Molly Maids, Fantastic Sams, BP and Subway.

About Joe Mathews, Founder and CEO

Joe Mathews is a 32-year franchise veteran and thought leader in franchising. Mathews has written 4 books on franchising, including the Amazon.com best-seller Street Smart Franchising. Mathews has written or contributed to over 70 articles on franchising featured in the Wall Street Journal, USA Today, Entrepreneur, Franchising World, and Franchise Update.

Start a Conversation

If you are an intelligent emerging growth or resurgent brand with strong unit-level economics and sound business fundamentals, but you aren’t actualizing your growth potential, we should talk.

Or if you are leading a brand turnaround, assembling your team, and crafting a competitive offering, we should talk.