By Joe Mathews, CEO of Franchise Performance Group

Private equity (PE) firms have been aggressively entering franchising over the last 10 years. A few years ago I hosted an IFA roundtable on franchise development strategy, and out of the dozen or so participants, 8 were partners in PE firms looking to acquire franchisors while learning about franchising. At any given time, half or more of FPG clients are PE-backed franchisors or PE firms themselves.

If you read the backgrounds and credentials of many PE Managing Directors and Partners you will quickly come to the conclusion they attack business with a classical MBA strategic approach bolstered by observation, data, and metrics. Having worked with PE partners, I’ve found PE groups often know each other and share observations and applied learning with the same level of transparency and familiarity as franchisor executives do at IFA events.

As PE firms have gained experience in franchising, how they think about and evaluate franchisor investments have evolved through three distinct paradigms. The latest paradigm is likely to forever transform franchising.

Here is a brief look at how PE’s three paradigms have evolved, and where the current paradigm is headed. PEs, franchisors, and vendors who embrace this evolution stand to reap strong returns for ownership and shareholders.

Old PE Paradigm 1: Franchisors are like any other B-to-B or B-to-C retail or service model

PE firms bought franchisors thinking they were buying typical consumer-facing models. When they were confronted with typical leadership issues and organizational resistance and demands that franchisees bring, they quickly learned that franchising is a business unto itself. Often, these investments were passed through loan committees with very little diligence done on the quality of the brand as a franchisor. Inexperience in franchising often became the brand’s primary limiting factor.

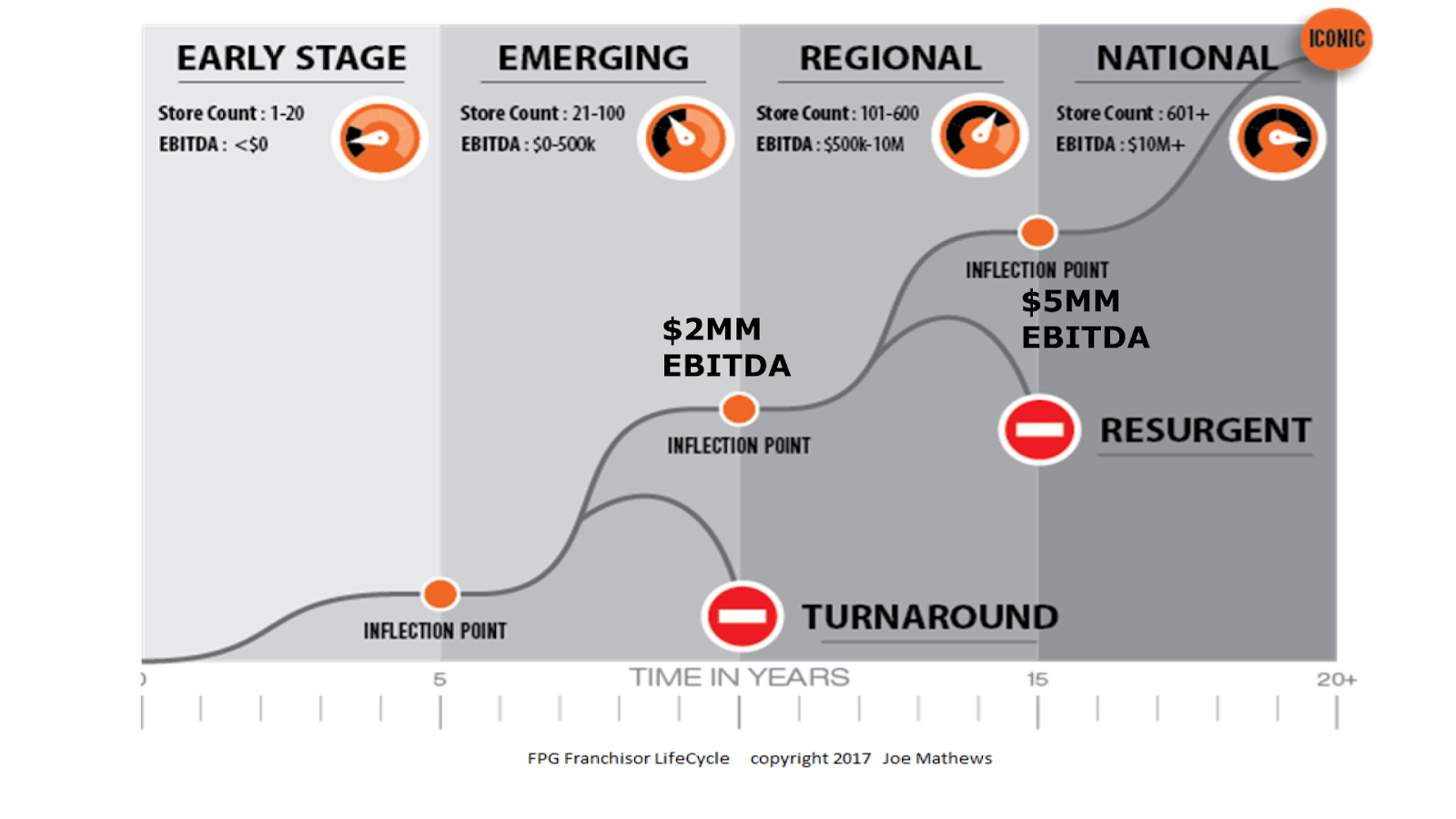

Many PE firms raised $100MM or more and thus were looking for franchisors with $5MM in EBITDA or greater, which created a strong market for the top 5% to 10% of franchise brands. These brands were being valued at 10X of EBITDA or more, creating enterprise values of $50MM and more. This caused tremendous competition for few deals, driving enterprise values higher.

Paradigm shift 1: PE realized every franchisor is in two businesses: the consumer-facing model and the business of franchising

And the greatest limiting factor of a franchise brand is whichever business they are weakest in.

Current PE Paradigm 2: the emergence of the value-add, smart money fund, and the platform play

Experienced franchise executives and large multi-unit franchisees then entered the PE picture and started heading up funds. Based on their past success as franchisees and executives, they believed they could take 100++ unit or territory franchisors and use their operations expertise to drive the business forward towards critical mass.

Many began looking at investments as low as $2MM in EBITDA, catching late stage Emerging Growth brands earlier in their growth cycle. They knew that the growing from $2MM to $5MM+ can happen in just a few years if the franchisor has its operations figured out. As FRANdata and FranConnect recently estimated, more than 80% of brands have fewer than 100 locations or territories and competition for these deals quickly escalated, driving enterprise value higher. These brands quickly started selling at 8-10X EBITDA or more, creating an enterprise value of up to $20MM.

These funds would often look to start by acquiring an anchor brand and then acquire similar or related franchise brands they could fold into the anchor brand organization to achieve economies of scale. Platform players like Neighborly (formerly Dwyer Group), Roark, and others pioneered this approach and achieved great success.

But some of these smart money funds were less successful because while the leaders had achieved strong individual success as franchisor executives and franchisees, they lacked franchisor processes, systems, training programs, and intellectual property required to scale multiple franchisor brands simultaneously. Because these brands were often earlier in the franchisor life (late stage Emerging Growth Brands rather than mature Regional and National Brands), these brands demanded more time, expertise, and scalable franchisor processes and systems to scale the brand. The needs were greater than the simple advisory services some of these fund’s leadership had the ability to provide, which hurt growth and stymied enterprise value.

Paradigm Shift #2: Aside from strategic advice, franchisors need franchisor-model intellectual property (proven and scalable franchisor processes, systems, and best practices that can be embedded into multiple brands simultaneously) to grow enterprise value, mitigate risk, and achieve economies of scale.

For instance, a partner of a $2 billion PE firm with a franchisor fund once told me his business mantra: “Buy right, build right, sell right.” FPG signed an operating agreement with this firm to be the “build right” in order to “sell right” part of his equation. They valued our franchise development system, intellectual property, and dedicated team as a multi-brand growth accelerator which drives enterprise value. They valued our philosophy of only recruiting top franchisee talent who support the CEO’s vision and have the requisite capital, skills, and desire to execute well. Equally, they valued our desire and discipline in red-flagging franchise candidates who may represent marginal performance, drain organizational resources, and create brand risk. This Partner understood that in a franchise brand, great execution starts with great franchisee recruitment. And great franchisee recruitment means knowing to whom and when to say, “yes” and when to say “no.” and maximizing your wins with those are a fit. They also used FPG to provide diligence and feedback as to the quality and predictability of earnings as a franchisor, not the consumer-facing model, which was a separate and distinct diligence process.

Based on these conversations I have had with the leadership of multiple PE firms involved in franchising, I believe PE paradigm 3 is now underway.

According to Joe St. Geme, Director at Thompson Street Capital Partners, their goal is to partner with motivated franchisor leadership teams and provide them with resources such as consulting, infrastructure investments, and operational best practices to help accelerate the growth of their brands.

Along the same lines, Satya Ponnuru, Partner with NewSpring Capital, said his firm likes to invest in companies with great brands and strong customer value propositions, proven unit-level economics and great management teams at an inflection point. “NewSpring provides both the financial and human capital brands need to accelerate growth and profitability.”

Future PE Paradigm 3: Franchising as a platform unto itself

For years franchisor executives have successfully migrated across diverse business categories such as food, hospitality, home services, pet services, child services, automotive, senior care, education, and others. Franchisor executives understand “franchising is franchising,” meaning that aside from the product and services being marketed, franchise brands act materially the same.

FPG defines franchising as “recruiting, training, developing, resourcing, and leading a team of entrepreneurs to build a brand.” When we present this definition to career franchise executives, we are always met with a nod of agreement. Missing from this definition is any mention of a brand’s product or service.

Along this vein, franchise executives have been successfully migrating their personal brand of know-how and intellectual property in franchisee recruitment, logistics, operational training and support, and finance for years. And it works.

But franchising has never done for franchisors what successful franchisors do for franchisees, which is to codify the entire model, including such things as:

- Strategies, tactics, people, and systems for franchise candidate lead generation and franchisee recruitment to stimulate quality growth.

- Training and support for developing the franchisor’s staff who work with franchisees training, coaching, consulting, and conflict resolution best practices.

- Leadership and development training and support for franchisors in how to develop and maintain a franchisee friendly and participative franchisee-franchisor culture.

- Standardized franchisor metrics that predict the brand’s health and quality of earnings as a franchisor and what these metrics mean.

- A strategic playbook which details how franchisors predictably need to adapt and grow, with detailed inflection and reinvention points.

- Standard budgets, uses of capital, and organizational development plans for Emerging Growth franchisors.

The above intellectual property all exists as a hodge podge collection of vendors, suppliers, and in the minds of executives. But the franchisor winning formula was never documented and imparted in the same way a franchisor documents and imparts their model to a franchisee.

Put another way, franchising is a nearly trillion dollar business which has never been codified and professionalized.

Over the next decade, PE will professionalize franchising. There is too much at stake not to.

PE firms will start buying thought-leading suppliers with strong intellectual property with the same gusto they are now buying franchisors. For instance, FPG has helped franchisors collectively recruit over 4,000 franchisees and build over $1-billion in enterprise value with our franchise development processes and systems. What is the value of FPG’s capacity and experience to a PE firm who owns or is planning to own 10-20 brands? What is the value of Greg Nathan’s Franchise Relationships Institute to drive culture change, and FranConnect’s back end systems for standardization of measurement and reporting?

PE Paradigm Shift 3: The need for a “franchisor of franchisors.”

PE will develop intellectual property and partner with franchising thought leaders to codify the franchisor model, offering portfolio brands the same quality centralized services such as training, support, and marketing services a quality franchisor offers its franchisees. The 80%+ of Emerging Growth franchisors plus turnaround brands will place a high value on both franchisor model intellectual property and support team who will help the brand master and embed the franchisor model.

Such PE firms will differentiate themselves in the market not by the size of their checkbook, but by the value they add through their proven PE brand and franchisor processes, systems, and support, driving the likelihood for a fairytale exit.

Remember the PE Partner’s adage: “Buy right, build right, sell right.”

Undercapitalized, outmanned, and outgunned owners of quality brands will sell some or controlling interest of their brands at a discount for their chance at $5MM+ in EBITDA and a $50MM-$200MM exit. Intellectual property and smart money funds marketed properly will solve the “buy right” and “build right” sides of the equation. And if a brand is profitable and built right, sell right part of this equation will always take care of itself.

Eventually, PE firms will brand their franchisor IP (such as Neighborly) in such a way franchise candidates will begin to place a higher value on these brands than franchisors perceived with less experienced ownership and homespun or incomplete franchisor processes and systems.

Additionally, PE will start creating smaller emerging growth funds aimed at franchisors with 10-100 units, offering proven value-added resources in franchisor best practices to create feeder systems and proprietary deal flow for the larger funds they or their colleagues own, akin to the way minor league baseball teams are a feeder system to the major leagues.

Eventually, there will be a robust economy of PE firms participating in and adding value in every stage of the franchisor Life Cycle, buying and selling brands among themselves, professionalizing franchising, adding more value to the customer and better returns for the franchisors and franchisees, creating a win-win-win scenario.